Is Trading 212 Halal or Haram? Is buying and selling 212 halal? It’s no secret that the arena of finance can be a murky one. For Muslims, who are required to comply with Shariah law, this can pose a trouble. Many economic products and services are truly not permissible beneath Islam.

This is in which Trading 212 comes in. Trading 212 is a UK-primarily based online broker that offers buying and selling in a extensive range of assets, along with stocks, foreign exchange, commodities and indices. But is Trading 212 halal?

Table of Contents

- What is Halal?

- What is Trading 212?

- Is Trading 212 Halal?

- Source

- FAQ

- Is Trading 212 halal (permissible) in Islamic finance?

- I exchange stocks with Trading 212 and still comply with Islamic finance principles?

- Conclusion

What is Halal?

Halal finance is a term used to describe financial services and products which can be permissible beneath Islamic regulation. This type of finance is based totally on the concepts of fairness, transparency, and hazard sharing, and is designed to promote economic increase and development in step with Islamic values.

There is a growing call for for halal finance services and products round the world, as Muslims are seeking to invest their cash consistent with their non secular ideals. In current years, some of Islamic banks and economic establishments have been established to meet this call for, and a number halal-compliant services and products at the moment are to be had.

Halal finance can be used for a huge range of purposes, inclusive of funding, lending, and coverage. Islamic banks provide a range of deposit accounts, home financing, and commercial enterprise loans which are compliant with Shariah regulation. Insurance merchandise that are to be had include takaful (Islamic coverage) and sukuk (Islamic bonds).

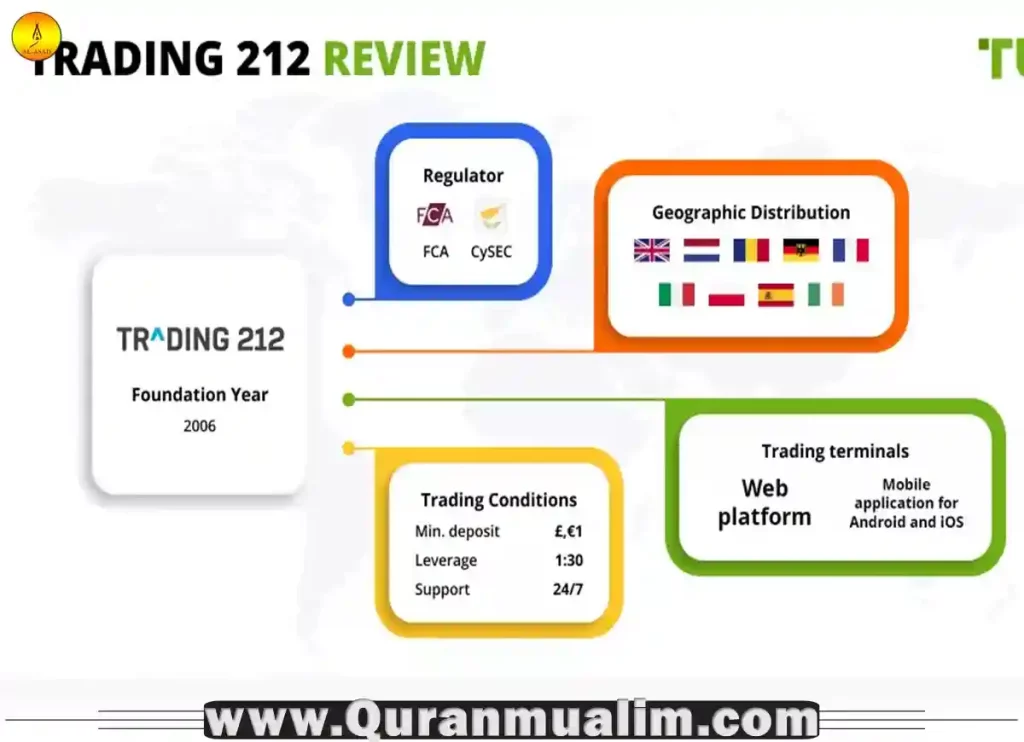

What is Trading 212?

Trading 212 is an online trading platform that allows you to exchange a wide variety of financial devices, including stocks, foreign exchange, CFDs, and crypto.

With Trading 212 you may change on the go together with their mobile app, or trade directly from your browser with their web-based totally platform. You also can use Trading 212’s demo account to practice your trading strategies before you hazard any actual money. Whether you’re a beginner or an skilled trader, Trading 212 has the entirety you need to begin trading and develop your portfolio.

Is Trading 212 Halal?

With the rise of Islamic finance, increasingly more Muslims are seeking out methods to put money into accordance with their non secular beliefs. Trading 212 is a popular online broking that offers investors the capability to trade a huge variety of property, which include stocks, forex, commodities, and indices. But is Trading 212 halal?

The short answer is yes, Trading 212 is halal. This is because the dealer offers traders the ability to change shares which can be compliant with Islamic regulation. So long as the shares you’re trading are halal, you could exchange with Trading 212 with out running afoul of your spiritual beliefs.

Of route, it’s constantly crucial to do your own studies to ensure that the stocks you’re buying and selling are in truth halal. But if you’re looking for a broker that gives Islamic-compliant buying and selling, Trading 212 is a great choice.

Source

Reference – The above information is proven thru Islam Question and Answer.

FAQ

Is Trading 212 halal (permissible) in Islamic finance?

It relies upon at the particular funding options and practices of Trading 212. In preferred, Islamic finance prohibits incomes or paying interest (riba) and tasty in speculative or unsure economic transactions (gharar).

Therefore, if Trading 212 gives funding options that are not sharia-compliant or engages in speculative practices, it would probably be considered haram (forbidden) in Islamic finance. However, if the platform is gives sharia-compliant options and follows sharia-compliant practices, it may be taken into consideration halal (permissible) in Islamic finance. It is important to visit a qualified Islamic finance professional or a sharia board to decide the permissibility of Trading 212.

I exchange shares with Trading 212 and nevertheless observe Islamic finance standards?

Trading shares isn’t inherently haram in Islam, so long as the shares being traded aren’t from groups worried in haram sports consisting of gambling, alcohol, tobacco, or other prohibited industries. Additionally, it’s crucial to avoid speculative or unsure financial transactions (gharar) and to make certain that the stocks are sharia-compliant. It is important to investigate and choose funding options that are sharia-compliant and to talk over with a qualified Islamic finance expert or a sharia board to decide the permissibility of a specific inventory.

Conclusion

as long as the shares concerned to your buying and selling are halal and compliant with Islamic finance principles, then Trading 212 can be taken into consideration halal as properly. It is critical to analyze and choose investment options which can be sharia-compliant and to keep away from speculative or uncertain financial transactions (gharar).

It is likewise vital to ensure that the shares you’re buying and selling are not from corporations involved in haram sports such as gambling, alcohol, tobacco, or different prohibited industries. If you’re uncertain about the popularity of a specific stock, you can continually test with a qualified Islamic finance expert or a sharia board to make sure.

It’s additionally worth consulting with a qualified economic advisor or an Islamic finance professional to make certain that your investment alternatives align along with your values and principles. Additionally, it’s crucial to do your personal research and due diligence whilst thinking about any funding platform. Happy buying and selling and continually stay compliant with Islamic finance principles!

Written By Alasad online Quran Tutor

QuranMualim is an Islamic pupil, writer and External Consultant at Renewable Energy Maldives. He writes on Islamic finance, food and halal dietary pointers. He is a respected voice in the Muslim community, known for his clean reasons of complex religious standards. He has been invited to talk at various conferences and seminars on topics related to Islamic finance, food and Renewable Energy.

Click Here To Find Out:

- Are Fake Nails Haram?

- Is It Haram to Dye Your Hair?

- Are Lip Fillers Haram in Islam?

- Is CBD Halal? Quick Guide 2023

- Why Are Lash Extensions Haram?

- Are Anklets Haram? Updates 2023

- Are Hair Extensions Haram in Islam?

- Are Zodiac Signs Haram? Quick Facts

- Is Botox Haram In Islam? Quick Guide

- Best Halal Nail Polish Collections 2023

- Do Muslim Women Shave? Quick Facts

- Are Nose Jobs Haram? Quick Facts 2023

- Are Tampons Haram in Islam? Facts 2023