Is Investing in Stocks Haram? Investing in stocks is not taken into consideration haram in Islam, so long as the shares aren’t acquired from organizations working in prohibited industries or in a manner that goes against Islamic principles.

Is making an investment in stocks haram? When it involves making an investment within the inventory market, there is a lot of debate approximately whether or not or now not it is halal (permissible in keeping with Islamic law).

Some humans consider that it’s miles haram as it involves gambling and hypothesis, even as others believe that it is permissible if executed in a responsible and considerate manner. But what’s the answer? Make certain you read below to find out.

Table of Contents

- What is Haram?

- What are Stocks?

- Is Investing in Stocks Haram?

- FAQ

- Can You Invest in Stocks in Islam?

- Is Stock Trading Haram in Islam?

- Conclusion

- Take It a Step Further

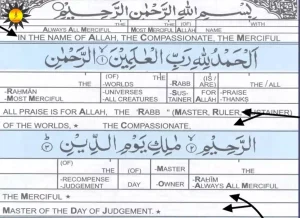

What is Haram?

Haram behavior is any behavior that is forbidden by way of Islamic regulation. This includes everything from dishonest and stealing, to lying and gossiping. It also covers more extreme offences consisting of homicide and terrorism.

There are a number of reasons why sure behaviors are considered haram. In some cases, it is because they are harmful to others. For example, dishonest is arbitrary to people who are being deceived, even as lying can damage relationships and reason human beings to lose accept as true with in one another.

In other instances, haram behaviors are taken into consideration sinful because they move in opposition to the teachings of Islam. For instance, Muslims are predicted to be sincere and straightforward, so mendacity is taken into consideration a serious offence. Similarly, Muslims are discouraged from carrying out gossip or backbiting, as this can hurt different human’s emotions.

Ultimately, the purpose of Islamic regulation is to sell justice and goodness in society. By prohibiting certain behaviors, it facilitates to create a extra harmonious and peaceful global.

What are Stocks?

Stocks, additionally referred to as equities or shares, represent possession in a organization. When you purchase a stock, you turn out to be a partial proprietor of the corporation and are entitled to a portion of its earnings and property. Companies problem stocks as a manner to raise capital for his or her operations and growth, and the rate of a inventory is decided with the aid of deliver and demand in the marketplace.

Stocks can be bought and sold on stock exchanges, which include the New York Stock Exchange or the NASDAQ. The value of a stock can boom over time if the business enterprise plays nicely and earns a earnings, or it is able to decrease if the corporation experiences economic difficulties.

Investing in shares may be a manner to grow your wealth over the long time, but it additionally consists of risks. The fee of shares may be stricken by many elements, along with changes in the economic system, agency overall performance, and market conditions.

Is Investing in Stocks Haram?

Investing in shares is normally not considered haram in Islam, so long as the stocks are not acquired from organizations working in prohibited industries or in a manner that is going against Islamic ideas. According to Islamic finance concepts, making an investment in companies worried in sports consisting of alcohol, playing, red meat, or some other sports deemed unethical or harmful to society isn’t permissible.

Additionally, investing in stocks with immoderate interest (riba) or undertaking speculative buying and selling that entails excessive uncertainty (gharar) is likewise discouraged. However, making an investment in businesses that function ethically and in the limitations of Islamic hints is acceptable, and Muslims often seek halal funding opportunities to make certain compliance with their religious ideals.

Source Reference – The above information is confirmed via Islamicly.

Types of shares

Shares can be divided, consistent with the sphere of interest and paintings concerned, into three classes:

- Shares based on permissible work, along with businesses that cope with transportation, transport, manufacturing garb, tools, office substances, fixtures, scientific equipment, real estate, and so on, and do not engage in any haram practices or transactions, which includes cheating, or lending or borrowing on the idea of riba; rather they follow Islamic rulings in all their transactions and dealings.

These styles of businesses are known as “permissible” or “clean” businesses, and it’s miles permissible to buy and promote stocks in them.

- Shares based on prohibited styles of paintings, together with businesses that address tourism, resorts that promote and useful resource in immoral actions, breweries, riba-based banks, industrial insurance groups, companies that print and distribute indecent magazines, and so on. It isn’t permissible to shop for stocks or put money into this form of organisation, and it isn’t permissible to market it them or sell them.

With regard to those types of groups, there’s no confusion approximately the ruling and the problem is pretty clear.

- Companies whose area of labor is basically permissible, however they have interaction in a few haram practices or transactions, including transportation businesses – as an example – which have hobby-bearing bills within the bank, or they’re financed via riba-based totally loans from banks or from human beings within the form of stocks.

These varieties of companies are known as “mixed” agencies. The contemporary students differed regarding the ruling on them, but the most correct view is that it is haram to shop for shares in them, put money into them or sell them.

That is because the shareholder is a associate inside the agency primarily based on the wide variety of stocks he holds, so he’s a associate to every transaction into which the company enters, along with riba or different haram transactions.

With regard to the prohibition on selling these agencies, that is due to what that involves of co-operating in sin and transgression, helping to spread haram and inflicting human beings to fall into it. Allah, may additionally He be exalted, says (interpretation of the which means):

“Help you each other in Al-Birr and At-Taqwa (distinctive feature, righteousness and piety); however do now not assist one another in sin and transgression” [al-Maidah 5:2].

This view was favoured with the aid of the majority of contemporary scholars, together with the students of the Standing Committee for Issuing Fatwas within the land of the 2 Holy Sanctuaries. A announcement to that effect was also issued via the Islamic Fiqh Council belonging to the Organization of the Islamic Conference, in addition to the Islamic Fiqh Council belonging to the Muslim World League.

It says in Fatawa al-Lajnah ad-Daimah, 14/299:

“The basic principle is that it is permissible to hold stocks in any organisation if it does not address haram things along with riba and so forth. But if it does address haram matters including riba, then it isn’t always permissible to hold shares in it.

Based on that, if any of the stocks mentioned are in a agency that deals with riba or haram matters, then it’s miles vital to withdraw from it and eliminate any earnings by giving it to the negative and needy.” (Shaykh ‘Abd al-‘Aziz ibn ‘Abdullah ibn Baz, Shaykh ‘Abd ar-Razzaq ‘Afifi, Shaykh ‘Abdullah ibn Ghadyyan, Shaykh Salih al-Fawzan, Shaykh ‘Abd al-‘Aziz Al ash-Shaykh, Shaykh Bakr Abu Zayd)

It additionally says (14/299, three hundred):

“Firstly: if it’s miles tested that a enterprise offers in riba , whether or not taking or giving, it is haram to preserve shares in it, because that comes underneath the heading of helping in sin and transgression. Allah, might also He be exalted, says (interpretation of the that means):

“Help you one another in Al-Birr and At-Taqwa (distinctive feature, righteousness and piety); however do no longer assist one another in sin and transgression. And fear Allah. Verily, Allah is Severe in punishment” [al-Maidah 5:2].

Secondly: if someone formerly received shares in a enterprise that offers in riba, then he has to sell his shares in it and spend the interest on charitable causes.” (Shaykh ‘Abd al-‘Aziz ibn ‘Abdullah ibn Baz, Shaykh ‘Abd ar-Razzaq ‘Afifi, Shaykh ‘Abdullah ibn Ghadyyan, Shaykh ‘Abdullah ibn Qa‘ud)

Statement of the Organization of the Islamic Conference on stocks

- The Islamic Fiqh Council belonging to the Organization of the Islamic Conference issued a statement regarding shares in its seventh conference, held in Jeddah, 7-12 Dhu’l-Qa‘dah 1412 AH/ 9-14 May 1992 CE, in which it says:

- As the primary precept regarding transactions is that they’re permissible, founding a share-primarily based company that has Islamically proper aims and sports is something this is permissible.

- There is no difference of opinion concerning the prohibition on conserving shares in businesses whose fundamental targets are haram, along with dealing in riba, or producing or buying and selling in haram matters.

- The basic precept is that it’s miles haram to preserve shares in organizations that occasionally deal in haram things, consisting of riba and so forth, in spite of the reality that their fundamental activities are Islamically ideal.” (Majallat al-Majma‘, issue no. 6, vol. 2, p. 1273; difficulty no. 7, vol. 1, p. Seventy three; trouble no. 9, vol. 2, p. 5)

Statement of the Islamic Fiqh Council of the Muslim World League on stocks

The Islamic Fiqh Council of the Muslim World League issued a assertion on the same remember in its fourteenth session in 1415 AH/1985 CE, the text of that’s as follows:

- “As the basic principle concerning transactions is that they’re permissible, founding a percentage-primarily based business enterprise that has Islamically suited ambitions and sports is some thing that is permissible.

- There is no distinction of opinion regarding the prohibition on keeping stocks in companies whose simple pursuits are haram, which includes dealing in riba, or production or buying and selling in haram matters.

- It is not permissible for a Muslim to buy stocks in companies or banks if a number of their transactions involve dealing in riba, or production or buying and selling in haram things.

- If an character purchased shares not understanding that the company deals in riba, then he finds out about that, what he ought to do is get out of it.

The prohibition in this case is apparent because of the overall meaning of the proof inside the Quran and Sunnah regarding the prohibition on riba, and because shopping for shares in agencies that cope with riba while the customer is aware about meaning that the client himself is a accomplice in dealing in riba, because the proportion represents part of the organisation’s capital, and the shareholder has a share in the organisation’s activities and possessions. So if the business enterprise lends any cash with interest, or borrows with hobby, the shareholder has a proportion of that, because folks that address lending and borrowing on the idea of hobby are doing that on his behalf and performing as his delegate, and delegating a person else to do a haram movement isn’t always permissible.

May Allah send blessings and peace upon our Prophet Muhammad and upon his family and companions. Praise be to Allah the Lord of the Worlds.”

Dr. Muhammad ibn Sa‘ud al-‘Usaymi (might also Allah hold him) became asked about the ruling on making an investment in mixed stocks.

He spoke back: “It is not permissible in step with the majority of scholars, except making an investment in “clean” shares, whether one is buying stocks or making an investment .”

Are all stocks in all varieties of organizations haram?

With regard to the view that shares in all varieties of companies are haram, this view is incorrect, due to the fact there are some businesses of the primary kind, that are the ones that adhere to Islamic rulings of their dealings. But possibly folks that are of this view had been inspired to say that due to the fact corporations of the first type are only a few and most companies are of the second one and third sorts.

And Allah knows nice.

FAQ

Can You Invest in Stocks in Islam?

Yes, investing in stocks is usually allowed in Islam, so long as sure situations are met. According to Islamic finance ideas, making an investment in corporations that function in permissible industries and behavior their enterprise in an moral manner is permissible. However, investing in organizations concerned in sports which are considered haram, consisting of alcohol, playing, red meat, or other unethical practices, is not allowed. Muslims are recommended to are seeking for halal investment possibilities that align with their spiritual beliefs and values.

Is Stock Trading Haram in Islam?

Stock trading itself isn’t inherently haram in Islam. The permissibility of inventory buying and selling depends on the character of the stocks being traded. Engaging in halal stock trading, which includes investing in Sharia-compliant groups and adhering to Islamic finance standards, is authorized. On the other hand, trading stocks of organizations worried in haram sports or undertaking speculative trading with excessive uncertainty and threat is not permissible in Islam. Therefore, it is essential for Muslims to cautiously investigate the nature of the stocks they change and make sure that their investments observe Islamic tips.

Conclusion

Stocks are not haram and are clearly permissible to invest in. Many human beings mistakenly assume that shares are gambling, however this isn’t the case. Stocks are a legitimate way to earn cash and might provide a fantastic return on investment. If you’re looking for a manner to invest your money, stocks have to honestly be considered. Thanks for analyzing.

Take It a Step Further

Now which you understand the halal or haram stocks, it’s time to deepen your expertise. Here are some beneficial assets to understand extra about stocks:

Written By Alasad online Quran Tutor

QuranMualim is an Islamic student, author and External Consultant at Renewable Energy Maldives. He writes on Islamic finance, meals and halal nutritional suggestions. He is a respected voice inside the Muslim community, regarded for his clean explanations of complicated non secular ideas. He has been invited to talk at various conferences and seminars on topics associated with Islamic finance, food and Renewable Energy.

Click Here To Find Out:

- Are Fake Nails Haram?

- Is It Haram to Dye Your Hair?

- Are Lip Fillers Haram in Islam?

- Is CBD Halal? Quick Guide 2023

- Why Are Lash Extensions Haram?

- Are Anklets Haram? Updates 2023

- Are Hair Extensions Haram in Islam?

- Are Zodiac Signs Haram? Quick Facts

- Is Botox Haram In Islam? Quick Guide

- Best Halal Nail Polish Collections 2023

- Do Muslim Women Shave? Quick Facts

- Are Nose Jobs Haram? Quick Facts 2023

- Are Tampons Haram in Islam? Facts 2023