Is roth IRA haram? The Roth IRA is a retirement financial savings account that lets in you to invest after-tax dollars. This method that you’ll no longer be capable of deduct your contributions out of your taxes, however all of the money in the account can develop tax-unfastened. When you reach retirement age, you may withdraw the money from your Roth IRA without having to pay any taxes on it.

For many humans, the Roth IRA is an terrific manner to shop for retirement. However, there are some who consider that investing in a Roth IRA is haram (forbidden with the aid of Islamic law). Let’s take a closer have a look at this difficulty to peer if there may be any advantage to this claim.

Table of Contents

- What is Haram?

- What is Roth IRA?

- Is Roth IRA Haram?

- Difference Between Roth Ira and 401k

- FAQ

- Can a Roth IRA spend money on stocks or mutual budget?

- How can I make certain that my Roth IRA follows sharia-compliant practices?

- Are there any sharia-compliant options to a Roth IRA?

- Can I withdraw my contributions from a Roth IRA at any time without penalty?

- Can I convert my conventional IRA to a Roth IRA if I observe Islamic finance ideas?

- Conclusion

What is Haram?

Haram finance is a form of financial interest this is taken into consideration to be forbidden by means of Islamic regulation. This includes activities together with riba (usury), playing, and speculation. Many Muslims trust that collaborating in those activities is a sin, and as such, they keep away from them altogether. However, some Muslims argue that sure forms of haram finance, consisting of interest-unfastened loans, can be permissible below positive situations.

There is lots of discussion among Islamic students about what does and does now not represent haram finance. As such, it is able to be difficult for Muslims to understand exactly which monetary sports are forbidden. This is why it’s critical to are seeking out the advice of a informed Islamic student in case you’re unsure about whether or not or now not a particular interest is permissible.

While haram finance is usually discouraged, there are some instances where it may be allowed. For instance, many Muslims agree with that hobby-loose loans may be permissible if they’re used for charitable functions. Similarly, some pupils argue that gambling is handiest forbidden if it’s executed for the motive of making a living.

Ultimately, it’s as much as each character Muslim to determine whether or now not they want to take part in haram finance. Some Muslims pick out to avoid it altogether, even as others accept as true with that there are a few permissible forms of haram finance. Ultimately, the decision is as much as you. If you’re uncertain about whether or not or not a specific hobby is permissible, it’s continually first-class to discuss with a informed Islamic pupil.

What is Roth IRA?

A Roth IRA is an individual retirement account (IRA) that gives tax-free increase and tax-unfastened withdrawals in retirement. Contributions to a Roth IRA are made with after-tax greenbacks, because of this you’ve already paid taxes on the money you’re setting into the account. That additionally manner you gained’t ought to pay taxes on any of the income your investments generate while they’re in the account.

Roth IRAs are a first-rate manner to keep for retirement because they provide the capability for tax-free growth and tax-loose withdrawals in retirement. That can be a large benefit over other varieties of retirement debts, which might also offer tax-deferred growth (which means you don’t pay taxes on the profits till you withdraw them) or taxable increase (that means you pay taxes at the earnings each year).

There are some matters to preserve in mind with Roth IRAs. First, there are contribution limits, which means you may best contribute up to a sure amount each 12 months. Second, there are profits limits, which means that that you can most effective make contributions if your income is beneath a certain stage.

And finally, withdrawals from a Roth IRA are situation to the identical regulations as different IRAs, which means you could ought to pay taxes and penalties if you withdraw the money earlier than you attain retirement age.

Despite those guidelines and boundaries, Roth IRAs can be a exceptional way to shop for retirement. If you’re eligible to make a contribution, recall starting a Roth IRA and taking gain of the tax-loose growth and withdrawals it gives.

Is Roth IRA Haram?

There is some debate over whether or not or not Roth IRA investments are permissible below Islamic law. Some students argue that as long as the contributions are not used to invest in hobby-based totally securities or businesses that coaching haram activities, then the Roth IRA is appropriate. However, different scholars take a stricter view and argue that any funding which can doubtlessly earn interest isn’t authorised. Therefore, it’s far essential to discuss with a religious scholar earlier than making any selections about investing in a Roth IRA.

Difference Between Roth Ira and 401k

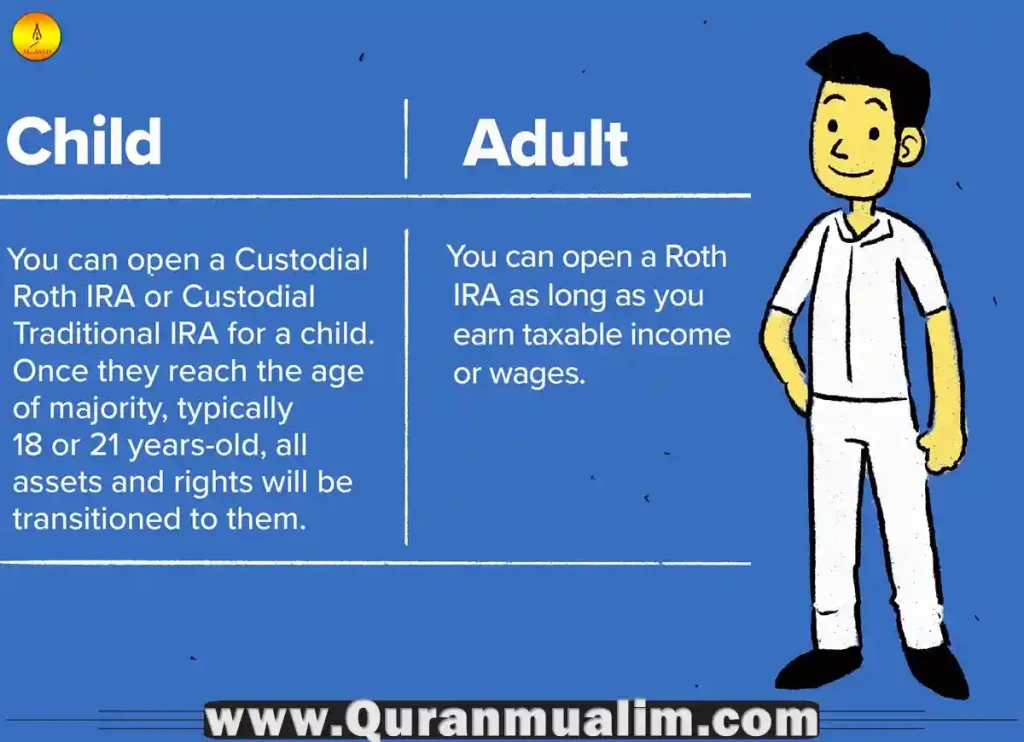

A Roth IRA and a 401(k) are each retirement financial savings plans that permit you to save for the destiny, however they have a few key differences. One major distinction is the contribution limits: a Roth IRA has decrease limits, even as a 401(k) has much higher limits.

Another difference is the eligibility necessities: anyone can make a contribution to a 401(k) as long as their employer gives one, while handiest those with earned profits beneath sure limits are eligible to make a contribution to a Roth IRA.

The tax blessings of these plans also are specific: contributions to a Roth IRA are made with after-tax dollars, even as contributions to a 401(okay) are made with pre-tax dollars. The funding options to be had in a 401(okay) are generally more restricted than the ones available in a Roth IRA.

In terms of withdrawal rules, a Roth IRA lets in you to withdraw your contributions at any time without penalty, however you could owe taxes and penalties on profits until you meet sure situations. With a 401(ok), you generally can’t withdraw budget with out penalty until you attain age fifty nine half of, until you meet certain situations. Finally, a 401(okay) is an business enterprise-backed plan, while a Roth IRA is an person retirement account that isn’t subsidized through an agency.

To read greater about other finance selections including whether options trading is halal or haram, make sure to study our blog!

Source Reference – The above facts is validated thru Nytimes.

Difference between Roth IRA and 401K

Here are the differences between a Roth IRA and a 401K

1. Contributions crafted from a ROTH IRA are put up-tax, while 401K contributions are pre-tax.

2. Some organizations offer 401K matching. We’re now not aware about a roth IRA matching program.

3. At the age of 59 and a 1/2, you don’t pay taxes while retreating money from your Roth IRA. With a 401K, you will pay some taxes.

Reminder: We are not making an investment experts and we propose you to do your research and are looking for advice from monetary experts.

Islamic Ruling on 401K, ROTH IRA, & RRSP Investing

We did a few research on this topic and sourced data from the professionals. Staring off with Mufti Muhammad Ibn Muneer. He finished his masters in Hadith from the university of Madinah to pursue his Islamic training. Mufti finished his masters in Hadith and is currently pursuing his PhD (supply).

He states that 90% of the time, the money people make contributions to their 401K, finally ends up being invested in haram stocks or companies that they may not recognize approximately. The lack of know-how on where the contributions are going makes it too volatile and maximum likely haram (source).

Investing in businesses within the following industries are known to be haram and are recognized to be non permissible for Muslims (source):

- Alcohol

- Gambling

- Weapons

- Tobacco

- Adult enjoyment

- Pork products

- Interest-based agencies

- Music, cinema or broadcasting

- Highly leveraged groups

He makes a compelling point that some personnel running at particular organizations are capable of ask approximately the stocks and mutual price range and request that or not it’s invested in extra halal-pleasant groups (supply).

Interest is any other factor he makes, if the contributions you make turn out to be making you extra money but from hobby (this commonly takes place when the 401K contributions grow to be being invested in bonds which yield a superb go back from hobby), then this is considered haram.

Halal Ways To Invest In Halal IRA or 401k

Here are 2 exceptional methods you can put money into a halal Roth IRA or 401K

1- Self Directed IRA or Solo 401K Plan

The U.S Retirement system allows everybody to use a self-directed IRA or Solo 401K plan (source). This allows Muslims to gain manage over their retirement account and keep away from investing in haram investments (organizations concerned in alcohol or playing, hobby yielding investments etc).

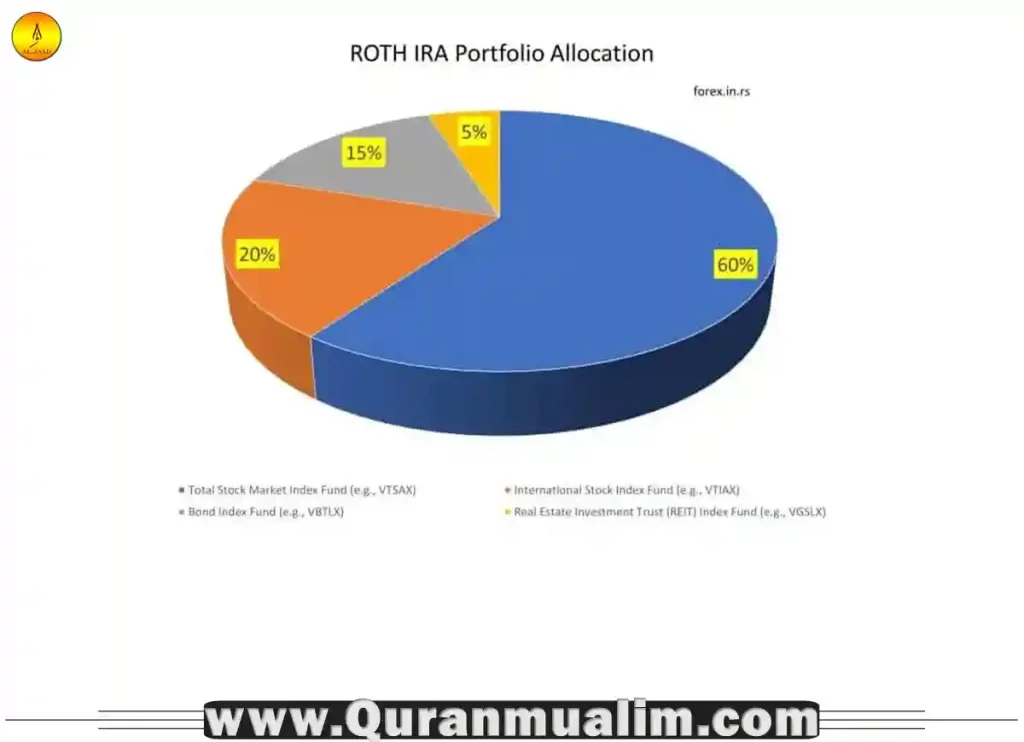

Through a self directed IRA or Solo 401K plan, Muslims can avoid hobby yielding investments by structuring their retirement plan to invest in real estate or debt associated investments in order that it’s far compliant with Sharia law (supply). For instance, in place of making an investment in bonds, Muslims can put money into real estate and be rewarded with a proportion from the income gained from the asset (source).

2- Tailoring A Plan With An Employer to Invest In Islamic Approved Mutual Funds

Companies like Wealth simple or Saturn Capital have halal and Islamic certified mutual finances. While maximum humans make contributions price range to their Islamic permitted mutual funds after receiving their salary, having a conversation together with your groups HR to request that they vicinity price range in comparable mutual price range (so you can nonetheless experience tax and matching blessings) is a amazing manner to growth your most important contributions for your investments.

FAQ

Can a Roth IRA spend money on shares or mutual finances?

Yes, a Roth IRA can put money into stocks or mutual finances so long as they are sharia-compliant, which means that they do no longer generate or pay hobby (riba) or have interaction in speculative or uncertain economic transactions (gharar).

How can I ensure that my Roth IRA follows sharia-compliant practices?

You can ensure that your Roth IRA follows sharia-compliant practices via researching and deciding on funds which have been vetted and authorized with the aid of a sharia board, or through consulting with a qualified Islamic finance expert to check your funding options.

Are there any sharia-compliant options to a Roth IRA?

Yes, there are sharia-compliant alternatives to a Roth IRA together with a sharia-compliant mutual fund, or a income-and-loss sharing investment account (PLS).

Can I withdraw my contributions from a Roth IRA at any time without penalty?

Withdrawals of contributions from a Roth IRA aren’t difficulty to taxes or penalties, but withdrawals of income before age 59 half of may be subject to taxes and consequences, until an exception applies.

Can I convert my traditional IRA to a Roth IRA if I comply with Islamic finance ideas?

Yes, it’s far viable to convert a conventional IRA to a Roth IRA at the same time as following Islamic finance standards, as long as the investments inside the conventional IRA are sharia-compliant and the conversion is finished in a manner that is consistent with sharia ideas. It is satisfactory to seek advice from a qualified Islamic finance professional or a sharia board to ensure that your conversion is in compliance with sharia standards.

Conclusion

After performing some research, it seems that making an investment in a Roth IRA isn’t always haram so long as your contributions aren’t going to hobby-primarily based securities or companies that exercise haram activities.

This is consistent with the ideas of Islamic finance which prohibits earning or paying hobby (riba) and attractive in speculative or unsure financial transactions (gharar). Therefore, it’s far critical to research and choose investment options that are sharia-compliant and has been vetted with the aid of a sharia board.

It’s additionally vital to note that the motive of a Roth IRA is to store for retirement without accruing hobby, which aligns well with the standards of Islamic finance. This makes it a suitable retirement savings choice for individuals who comply with Islamic finance principles.

As long as you’re investing in a way that is steady with Islamic values, a Roth IRA may be a incredible manner to keep to your future. It is important to consult with a qualified Islamic finance expert or a sharia board to make certain that your Roth IRA is in compliance with sharia ideas. Thanks for studying!

Written By Alasad online Quran Tutor

QuranMualim is an Islamic pupil, author and External Consultant at Renewable Energy Maldives. He writes on Islamic finance, meals and halal nutritional recommendations. He is a reputable voice inside the Muslim network, acknowledged for his clear factors of complicated non secular principles. He has been invited to talk at various meetings and seminars on subjects related to Islamic finance, food and Renewable Energy.

Click Here To Find Out:

- Are Fake Nails Haram?

- Is It Haram to Dye Your Hair?

- Are Lip Fillers Haram in Islam?

- Is CBD Halal? Quick Guide 2023

- Why Are Lash Extensions Haram?

- Are Anklets Haram? Updates 2023

- Are Hair Extensions Haram in Islam?

- Are Zodiac Signs Haram? Quick Facts

- Is Botox Haram In Islam? Quick Guide

- Best Halal Nail Polish Collections 2023

- Do Muslim Women Shave? Quick Facts

- Are Nose Jobs Haram? Quick Facts 2023

- Are Tampons Haram in Islam? Facts 2023