Zakat Calculator– In the month of Ramadan, is drawing to a close. Many Muslims worldwide could be trying to figure out what amount Zakat, an almsgiving or charity that is obligatory in Islam, they are expected to pay. What specifically is Zakat? Who is obliged to pay the amount? How is it calculated?

Gulf News spoke with Dr Mohammed Eyada Alkobaisi, Grand Mufti of the Islamic Affairs and Charitable Activities Department in Dubai. He gave a thorough explanation of this kind of charitable giving.

Who is obliged to pay Zakat?

There are two kinds of Zakat in Islam: Zakat-Al-Maal. It is the Zakat, depending on the wealth a person has, as well as Zakat-Al-Fitr, which is tied to Ramadan. Zakat-Al-Maal is different according to an individual’s income; the amount for Zakat-AlFitr is a specific amount as each Muslim is obligated to contribute the minimum amount before Eid Al Fitr, which is the day that marks the conclusion of Ramadan.

To qualify for Zakat-Al-Maal, However, you will need to be able to prove a minimum amount of wealth on which Zakat is required. The amount you have to pay is known as “Nisaab.”.

“The Nisaab for money was established in the name of Prophet Mohammed [PBUHto be worth 85g of gold 24 carats is roughly Dh20,723 in the present,” Dr Alkobaisi said.

Therefore, if an individual’s wealth total exceeds Dh20,723 and over, then they are required for Zakat.

What time do I have for Zakat?

Zakat is due once per Hijri year, which is less than a solar calendar. According to Dr Alkobaisi, Zakat is due every Hijri year after an individual’s wealth reaches the Nisaab.

“The day that the funds and savings of an individual attain the Nisaab date will be the Zakat due date. And the person has to pay Zakat simultaneously at the end of one Hijri year,” he said.

In other words, if your total income reached Nisaab at the time of the 10th of Ramadan, then that’s the day the Zakat will be due the following year. The Zakat would be due on the 10th of Ramadan every year following.

How do you calculate Zakat determined?

Zakat is calculated in different ways based on the type of income. Here’s how to determine the Zakat depending on your income goal,d jewellery, and any property you might have:

Zakat on my paycheck or savings in my bank

The calculation of Zakat doesn’t depend upon a salary. It is based on the amount you have at the Zakat deadline.

“Zakat is not tied to salaries that are deposited; however, it is linked to the amounts of money that were not used. The money used throughout the year is not considered when calculating Zakat,” Dr Alkobaisi declared.

“When it comes to the Zakat due date approaches, the person must make Zakat on every single dollar that remains with him or her at the time and also the cash just recently received”, said the official.

This is the most efficient method to determine the due date for Zakat in the sense that you have one Zakat due date each year.

“It is also permitted to write down a separate date for each new amount you get, and then offer Zakat on that amount one year later. However, this is a bit more challenging for most people. as a result, you’ll have numerous dates due for Zakat each year.” Dr. Alkobaisi explained.

Zakat is not correlated with the salary deposited; however, it is linked to the amount of money not utilized. The money used throughout the year must be counted when calculating Zakat.

Zakat calculator

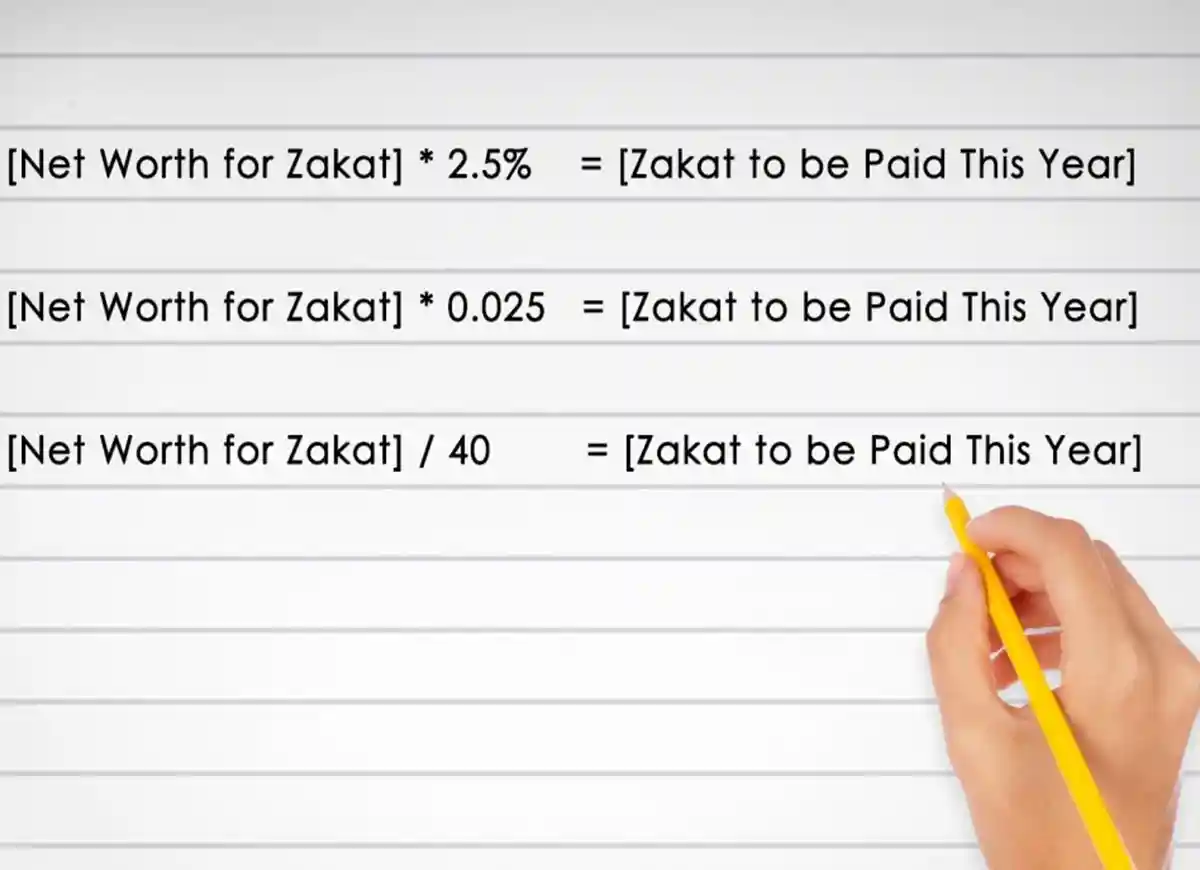

The amount of Zakat to be paid on the money is 2.5 per cent each Hijri year.

“The most efficient method of calculating this percentage is to simply take the amount you carry in your possession and then divide it by 40. The outcome will result in the Zakat amount to be distributed to the most deserving of people, such as those who are poor and in need,” Dr Alkobaisi said.

For instance, if someone’s bank account is Dh46,000 on the day of the Zakat day due, the Zakat payable is Dh1,150 (Dh46,000 40 x Dh1,150 equals Dh1,150).

How do I determine Zakat for gold?

What amount of gold should I have holding to allow Zakat to be repaid for it? Do you base it on the weight or value? Dr Alkobaisi declared a divergence in opinion among Islamic scholars regarding the Zakat on gold.

“If you believe that a woman’s jewellery is of a normal quantity like the rest of her friends, there’s no Zakat requirement on the jewellery by many scholars. When the jewellery is personal, and it’s greater than the normal amount she would normally have, it’s recommended to pay Zakat on the amount which is greater than the amount normally used, as certain scholars suggest. The typical amount of gold for a woman varies in different societies and the financial and social situation of the woman and her family members,” Dr Alkobaisi said.

“Scholar Imam Abu Hanifa stated that a woman must make Zakat for gold when it exceeds or reaches 85g, irrespective of whether it’s personal jewellery. This is a solid and more discerning view,” he said.

For the payment of Zakat on this jewellery, the easiest method to determine this is to look at the value at present of all the gold and then give 2.5 per cent of it as Zakat, according to Dr Alkobaisi.

If the jewellery made of gold has precious stones, their weight could be deducted first because there isn’t Zakat in the case of precious stones.

“She could give Zakat directly from the gold or through money or even sell some of the gold to pay for the Zakat,” he added.

If I own a property, How do I determine zakat?

The possession of property doesn’t necessarily require Zakat for an individual. The eligibility requirement is contiactuality on how the property is used, as per Dr. Alkobaisi.

“If you are using the house for private use, there isn’t Zakat for that property. If a property was purchased and used for use as a rental property, it is not Zakat regarding the cost of the property. However, you can get Zakat on the rental earnings when it is at its Nisaab of Zakat on its own or with any other money the individual can access. Any portion of the rental revenue spent during the year is not counted in the calculation of Zakat, which includes funds used to pay for maintenance, debt repayment or other expenses.

“On the contrary, Zakat needs to be due on properties for real estate trade, and the amount due for Zakat is 2.5 per cent. The calculation is made according to the property value on the date of the Zakat deadline.”

I’ve gotten a huge loan. Do I have one for Zakat?

What happens if the person has an outstanding loan they must repay? Does the debt impact the Nisaab, the overall wealth calculation, or the need to cover Zakat?

According to Dr Alkobaisi, the evidence suggests an opinion gap between Islamic scholars on Zakat and someone who is in debt. The issue is extremely complex. However,r, he su, summarised the findings of Islam’s most important school of thought.

“The Shafie school of jurisprudence believes that being in debt doesn’t negate Zakat and that the amount of debt is not refunded from the Zakat regardless of whether it is due or deferred or paid in instalments. The Maliki experts believe that the debt can be removed from Zakat only if there is no security for the debt with additional items or personal belongings.

“Some experts believe the debt must be removed from the Zakat. However, most scholars who permit the amount of debt to be taken out of the Zakat stipulate that the individual does not have other funds to pay for the debt. Suppose someone has additional funds beyond the basic requirements, like extra cars, homes, land, or furniture that exceeds the minimum requirements. In that case, he must apply the value of this additional money against the debt and then pay zakat on the rest of the amount. If the personal items or assets that go above the necessities of life don’t cover the entire debt, then the amount does not meet the debt and is subtracted from Zakat, and they must pay Zakat on the entire amount,” he added.

Can you use it as a loan for a long time?

Another aspect to take into consideration is whether you’re using an immediate loan or a long-term loan.

“For longer-term loans that last more than one year in duration, you may take the current debt, which is due to be paid before the due date. Zakat due date. After that, you can give Zakat for the remainder of your funds and possessions if it reaches Nisaab; the Shafie view is believed to be more fitting because the future debt is not due. Therefore, the money in your account is still yours, and you can make use of it as you like. In addition, the majority of long-term debts are secured by wages or secured by other property in addition to being usually covered and cancelled in the event of disability or death. Therefore, you must pay Zakat on every dollar you carry at your zakat time, except for non-paid instalments due to the loan, in case there are any,” he said.

Need help calculating your Zakat? This number can help you.

Even though Zakat for gold, financial savings, or property might be the most commonly used calculations that people have to make, There are many other types of Zakat, such as Zakat on livestock, market shares fruit and crops such as rare minerals or ore.

“We want to advise readers to call our Fatwa service via 800 600, our toll-free phone number, accessible throughout the week, during working hours and even after closing hours.” Dr. Alkobaisi said.

The UAE Zakat Fund – an online Zakat calculator

It is also worth noting that the UAE also established the Zakat Fund in 2000. it was created by Sheikh Zayed bin Sultan Al Nahyan, the UAE’s founding father.

The website of the Fund offers an online Zakat calculator that can help calculate the Zakat you have to pay for your cash as well as silver, gold, and other types of wealth. To access the calculator, visit https://www.zakatfund.gov.ae/zfp/web/calculation/calculatemyzakat.aspx.

Recently, they’ve launched the Whatsapp service that allows users to determine the Zakat to be paid immediately.

Who is eligible to receive Zakat?

According to Dr Alkobaisi, Zakat distribution Zakat is also subject to specific guidelines that must be adhered to, determined by Chapter 9, Verse 60 of the Quran.

“Verily, Alms are for those in need and for the poor and the people who manage the (funds) for those whose hearts have been (recently) at peace (to Truth); for those who are in bonds; and for those who are in debt; and for those who are in the direction of Allah as well as for those who travel: (thus is it) that Allah has ordained Allah and Allah is abounding with wisdom and knowledge” — Quran Chapter 9 Verse 60.

Dr Al Kobaisi said that this was further emphasized through Prophet Mohammed [PBUHwhen a person was to Zakat and asked for a donation from Zakat, and the Messenger [PBUH] clarified the matter by telling him: “Verily, Allah did not approve of the rulings of a Prophet or any other in Sadaqah Zakat, until He ruled over it and divided it into eight parts. If you’re one of the eight parts, I will grant you. (Reported by the Hadith collection of Abu Dawood].

“That is why it is not permitted to donate Zakat to other groups or use it other than one of the eight categories”, Dr Alkobaisi said.

How and where can I pay Zakat?

Many registered charities across the UAE allow people to donate Zakat money at kiosks in malls and office locations by text, bank transfers, and online card payments.

“If you are unsure of worthy people you could help, give your money to authorized charities in your area in their Zakat account. Then they will donate it to people who are worthy in your name,” Dr Alkobaisi said.

Pay via Whatsapp. Call us at +923017363500

Email: hdhuddi@gmail.com

Website: www.quranmualim.com

ZAKAT:

- Zakah | Zakat al Mal | Zakat – Learn Islam

- Zakat ul Fitr | Muslim Charity – Learn Islam

- Beneficiaries of Zakat | Islamic Relief Worldwide

- Importance and The Significance of Zakat in Islam

- Zakat Facts | Importance of Zakat | Benefits of Zakat

- Zakat al Fitr: The Obligatory Eid Gift to Be Made Before The End of Ramadan

Categories: PRAYER (Salat), ALMS (Zakat), SAWN (Fasting) HAJJ (Pilgrimage) & DUA (Supplications), Hadith and Tafseer, The Holy Quran, Quran Jaz 1- 114

Topics: Ushr and Zakat, Hijab, Arabic Corner, Faith, Islamic History, Biography, Sirat ul Nabi PBUH, Islamic Studies, Halal & Haram