Zakah | Zakat al Mal | Zakat – Learn Islam-Being the owner of Nisab means that a person has 7.5 Tola (A Tola is a traditional Ancient Indian and South Asian unit of mass, now standardised as 11.66 grams.) of gold, or 52.5 Tola of silver, or cash equal to its price, or trade goods whose value is equal to its price, or possessions exclusive of Haajate-Asliyyah whose value is equal to its price. (Derived from: Bahar-e-Shari’at, vol. 1, pp. 902-905)

The ruling on giving Zakah before becoming the owner of Nisab

If a person gives Zakah first and then becomes the owner of Nisab, the wealth he has given will not be included in Zakah; in fact, its Zakah will have to be given separately.(Al-Fatawa-e-Hindiyyah, vol. 1, pp. 176)

The Zakah on Haraam wealth

Zakat al Mal | Zakat will not be Fard on the person whose total wealth is Haraam [unlawful] because he is not the owner of that wealth. It is stated in Durr-e-Mukhtar: If the total wealth is Haraam, there is no Zakah upon it. (Durr-e-Mukhtar, vol. 3, pp. 259). A’la Hadrat, Imam-e-Ahl-e-Sunnat, Maulana Ash-Shah Imam Ahmad Raza Khan has stated: How can that wealth become pure by giving the 40th part whose remaining 39 parts are also impure. (Fatawa-e-Razawiyyah, vol. 19, pp. 656) . It is necessary for such person that he repents and gets rid of the Haraam wealth.

The method of getting rid of Haraam wealth

There are two forms of Haraam wealth:

- Haraam wealth obtained through theft, bribery, usurpation and other similar means. The person who obtains it does not become its owner at all. Shari’ah has made it Fard to return this wealth to its owner; if he has died, it should be given to the heirs; if even they cannot be traced, it should be given to any Faqeer [Shari’ah-declared poor person] as charity without the intention of Sawab.

- That Haraam wealth by whose possession, a person acquires its impure ownership . It is the wealth acquired through any Aqd-e-Fasid [imperfect transaction], such as Riba [interest], or the earnings from shaving beard, cutting it to less than a fist length, etc. The same ruling applies to it as well but the difference is that it is not Fard to return it to its owner or his heirs; it can also be given to a Faqeer as charity without the intention of Sawab in the first place. However, it is Afdal [better] to return it to the owner or his heirs. (Derived from: Fatawa-e-Razawiyyah, vol. 23, 551 – 552)

The meaning of Maal-e-Naami

Maal-e-Naami means the wealth that grows, whether it grows actually or as Hukmi [invisibly]. There are its three forms:

- This growth will be due to trade.

- This growth will be due to leaving animals in a jungle for breeding.

- The wealth will be Naami by nature like gold, silver, etc. (Al-Fatawa-e-Hindiyyah, vol. 1, pp. 174)

What is Haajat-e-Asliyyah?

Haajat-e-Asliyyah (i.e. basic necessities of life) refers to all those things which a person generally requires and one faces serious problems and difficulties in spending life without them, such as the house one lives in, clothes one wears, conveyance, books related to knowledge of Deen, tools related to one’s occupation, etc. (Al-Hidayah, vol. 1, pp. 96)

For example, the following are included in Haajat-e-Asliyyah: Telephone or mobile phone for those who need to contact different people; computer for those who write books using a computer or earn a livelihood through it; glasses or lenses for those who have poor eyesight; hearing aid for hearing-impaired people; likewise, bicycle for travelling; motor cycle, car or other vehicles; or other such things which a person needs and he finds difficulty in spending his life without them.

When will a year complete [for Zakah]?

The date and time when a person became the owner of Nisab, as long as the Nisab remains, the year will complete at the same minute when the same date and same time will come. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 202)

For example, at 12 pm on 12th of Rabi-ul-Awwal i.e. Eid Meelad-unNabi , Zayd received 7.5 Tola of gold, or 52.5 Tola of silver, or the amount of money equal to its value, or trade goods having value equal to its value; then, upon completion of the year at 12 pm on Eid Meelad-un-Nabi (12th of Rabi-ulAwwal), if he is still the owner of Nisab, paying Zakah of that wealth will become Fard [obligatory] upon him. He will become a sinner if he now delays paying the Zakah without any Shar’i reason.

Will lunar months be taken into account or calendar months?

For completion of the year, lunar months [i.e. months of Islamic calendar] will be taken into account. It is Haraam [prohibited] to take calendar months [i.e. months of the Gregorian calendar] into account. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 157)

Decrease in Nisab during the year

Since the start and end of the year are taken into account for Zakah to become Fard, if the Nisab of Zakah is complete on the completion of the year, the decrease (in Nisab) during the year has no effect; Zakah of the wealth [owned by the person] at that time will be given. (Durr-e-Mukhtar wa-Radd-ul-Muhtar, vol. 3, pp. 278, Wa-Fatawa-eHindiyyah, vol. 1, pp. 175)

For example, Bakr became the owner of 7.5 Tola of gold at 12 pm on 1st of Ramadan, so the same moment became the start of the year [of Zakah]. Then, he sold 1 Tola of gold in Shawwal, so the Nisab decreased. When Ramadan-ul-Mubarak was going to arrive next year, he received a gift of 1 Tola of gold from someone in the month of Sha’ban. So, he was again the owner of Nisab at 12 pm on 1st of Ramadan; therefore, he will now have to pay Zakah of that gold because the year has completed.

Increase in Nisab during the year

If a person is the owner of Nisab and he gains some more wealth of the same category during the year, the year of this newly gained wealth will not be different; in fact, completion of the year for this wealth is the same as for the previously owned wealth, even if he has gained this wealth just a minute before the completion of the year.

In this regard, it doesn’t matter whether this wealth has been gained through his previously owned wealth, or through inheritance, or as a gift, or by any other permissible means. If this newly gained wealth belongs to a different category, for example, a person first owned camels and now he got female goats, then a new, different year for it will be considered. (Bahar-e-Shari’at, vol. 1, pp. Mas’ala no. 43, pp. 884) Note: In this regard, gold, silver, currency notes and trade goods will all be considered as the same category. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 210)

For example, Zayd received 11,000 rupees on 11th of Rabi-ul-Sani, and then he received 12,000 rupees on 12th of Rabi-ul-Awwal in inheritance. He also received 25,000 rupees on 25th of Safar-ulMuzaffar as a gift or the house rent. In this way, Zayd possessed a total of 48,000 rupees at the end of the year. Now, according to Shari’ah, it is Wajib [compulsory] upon Zayd to pay Zakah of this total amount of money because all the currency notes fall into the same category; therefore, the same year of the previously owned 11,000 rupees will be considered for the amount of money which will be received during the year.

The loss of Nisab during the year

If the Nisab is lost during the year such that none of it remains, the year [of Zakah] that had started will no longer be considered; the day on which he will become the owner of Nisab again will become the new beginning of the year [of Zakah

]. For example, a person became the owner of Nisab on 1st of Muharram and in Safar, he lost his entire wealth; then he gained wealth again in Rabi-un-Noor, so this same month will become the beginning of the year [of Zakah]. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 89)

The state of Kufr

If a person who was previously a Kafir [unbeliever] embraces Islam, it is not Fard upon him to pay Zakah of [his past life he spent in] the state of Kufr because Zakah becomes Fard upon a Muslim, not on a Kafir. (Al-Fatawa-e-Hindiyyah, vol. 1, pp. 171 – 175)

It is on a Na-Baligh and insane person : Zakah is not Fard upon a Na-Baligh (Child who has not yet reached puberty.) There are some types of insane people:

- If a person remains insane throughout the year, Zakah is not Wajib upon him.

- If a person becomes sane in the beginning and end of the year, Zakah is Wajib upon him, even if he remains insane for the rest of the time period. (Derived from: Bahar-e-Shari’at, vol. 1, pp. 875)

Beginning of the ‘year of Zakah’ for an insane person

There are two types of Junoon [insanity]:

- Junoon-e-Asli

- Junoon-e-‘Aarzi

- If it is Junoon-e-Asli, i.e. a person becomes Baligh ( Person who has reached puberty) in the state of insanity, his year [of Zakah] will start when he becomes sane.

- If it is Junoon-e-‘Aarzi and a person remains insane throughout the year, the year [of Zakah] will start from the time when he regains sanity. (Derived from: Bahar-e-Shari’at, vol. 1, pp. 875)

The wealth for which Zakah becomes Fard

Zakah is [Fard] for three types of wealth:

- Gold and silver. (Their ruling applies to currency notes as well, provided that the notes are still in use).

- Trade goods.

- Saaimah, i.e. animals left for grazing. (Al-Fatawa-e-Hindiyyah, vol. 1, pp. 174, Fatawa-e-Razawiyyah, vol. 10, pp. 161, Bahar-e-Shari’at, vol. 1, pp. 882, Mas’ala 33)

The Nisab for gold and silver

The Nisab for gold is twenty Misqal, i.e. 7.5 Tolas, whereas the Nisab for silver is two hundred dirhams, i.e. 52.5 Tolas ( According to goldsmiths, 7.5 Tolas of gold approximately equals 87 grams and 48 milligrams, and 52.5 Tolas of silver approximately equals 612 grams and 41 milligrams.). (Bahar-e-Shari’at, vol. 1, pp. 902)

The Beloved Rasool has stated: When you own two hundred dirhams and a year passes on them, five dirhams are for them; and there is nothing upon you in gold until it becomes twenty Dinars. When you own twenty Dinars and a year passes on them, there is a half Dinar Zakah for them. (Sunan Abi Dawood, vol. 2, pp. 143, Hadees 1573)

What amount of Zakah will be given?

1/40th part of the Nisab (i.e. 2.5%) will have to be given as Zakah. (Fatawa-e-Amjadiyyah, vol. 1, pp. 378)

The ruling on the wealth which is more than the Nisab (Zakat al Mal )

If a person owns some amount of wealth which is more than the Nisab, it will be calculated whether the wealth more than the Nisab is equal to the one-fifth part (Khums) of the Nisab or not. If it is equal [to the one-fifth part], then 2.5 % of this one-fifth part (Khums), i.e. 1/40 part will have to be given as Zakah as well. If this additional amount of wealth is less than the one-fifth part (Khums), then it is exempted and there is no Zakah for it.

For example, if a person owns 8 Tolas of gold, he will have to pay Zakah of only 7.5 Tolas of gold because the additional amount of wealth (i.e. half Tola) is less than the one-fifth part of the Nisab (i.e. 1.5 Tolas). On the other hand, if a person owns 9 Tolas of gold, he will pay Zakah of 9 Tolas because this additional amount of wealth (i.e. 1.5 Tolas) is equal to the one-fifth part of the gold’s Nisab.(Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 85) ‘

Zakah for the wealth which is more than the Nisab and the one-fifth part

The wealth which is more than the Nisab and the one-fifth part but less than the second one-fifth part, is exempted; there is no Zakah for it. For example, if a person owns 10 Tolas of gold, he will give Zakah of only 9 Tolas; the 10th Tola is exempted. On the other hand, if a person owns 10.5 Tolas of gold, he will give Zakah of 10.5 Tolas because the second one-fifth part is now complete. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 85)

Different types of wealth of the same category and the calculation of iT

If a person owns different types of wealth and each type is [individually] less than the Nisab, the total value of the entire wealth such as gold, silver, trade goods or currency will be calculated and the calculation of its Zakah will be made according to that Nisab which brings about more benefit to the Fuqara [poor people].

For example, if the [amount of] Zakah will be more in making its calculation by considering the entire wealth as silver, then calculation should be made accordingly; and if the [amount of] Zakah will be more by considering [the entire wealth as] gold, then the calculation should be made accordingly. If remains the same in both cases, calculation will be made according to that type of wealth which is more commonly used by the people to pay Zakah. If both types of wealth are equally used by the people to pay Zakah, the Zakah-giving person has the choice that he may give Zakah according to gold or according to silver. It is stated in Fatawa Shaami: Combine [calculation] will be made according to the value [of that type of wealth] which will make the combine value reach the Nisab, not [the value] of the other. If both [types of] wealth make the combine value reach the Nisab and one of them is more commonly used, then the calculation will be made according to it. (Radd-ul-Muhtar, vol. 3, pp. 271)

It is stated in Sharah Niqayah: If both are equal (in being used by the people to pay Zakah), the Zakah-giving person will have the choice. (Sharah Niqayah, vol. 1, pp. 313)

If a person owns different types of wealth and each of them reaches the Nisab, there are three possibilities in this case:

First possibility: Each type of wealth is exactly equal to the Nisab and there isn’t anything more than the Nisab. (For example, a person owns 7.5 Tolas of gold and 52.5 Tolas of silver). In such case, if he wishes to [make] combine [calculation], that calculation will be made which results in greater [amount of] Zakah. (Derived from: Bida’-us-Sana’, vol. 2, pp. 108)

Second possibility: There will be some exempted amount of each type of wealth, more than the Nisab; so only the additional exempted amount of every type of wealth will be combined together and calculation will be made according to that Nisab which results in greater [amount of] Zakah. (For example, if a person owns 8 Tolas of gold and 53 Tolas of silver, both contain a half Tola of exempted amount, so calculation will be made after combining both of them.)

Third possibility: More than the Nisab, (Zakat al Mal) there will be some exempted amount of one type of wealth whereas the other type of wealth will have no exempted amount. In this case, only that additional exempted amount of the first type of wealth will be combined with the second type of wealth (having no exempted amount). For example, if the Nisab of gold has an exempted amount and the Nisab of silver has no exempted amount, only the exempted amount of gold will be combined with silver. (If a person owns 8 Tolas of gold and 52.5 Tolas of silver, calculation will be made after combining the additional (exempted) amount of gold with silver.) (Derived from: Al-Fatawa-e-Hindiyyah, vol. 1, pp. 179, wa-Fatawa-e-Razawiyyah, vol. 10, pp. 116)

The Nisab of gold is complete and that of silver is incomplete

Any one of the both [types of wealth] whose Nisab is complete (having no exempted amount); the other type of wealth will be combined with it. For example, if there are 52.5 Tolas of silver and 4 Tolas of gold, the gold will be combined with the silver; and if it is the opposite case, i.e. there are 7.5 Tolas of gold and 40 Tolas of silver, then the silver will be combined with gold. (Fatawa-e-Razawiyyah, vol. 10, pp. 115)

The price of gold and silver as Zakahat

Instead of [giving] gold or silver, it is [also] permissible to pay their price as Zakah. It is stated in Durr-e-Mukhtar: It is also permissible to pay the price as Zakah. (Durr-e-Mukhtar, vol. 3, pp. 250)

The Definition of price

According to Shari’ah, the market value of something is called its price. If something is purchased by chance or purchased for a greater or lesser amount after bargaining, this [amount, Zakat al mal] will not be called its price (in fact, it will be called ‘ثَمَن’). (Fatawa-e-Amjadiyyah, vol. 1, pp. 382)

Which price will be considered?

At the place where goods are actually sold according to the government rates, the same rates will be considered. If there is a difference between the government rate and the market rate, then the market rate will be considered. (Fatawa-e-Amjadiyyah, vol. 1, pp. 386)

Which area will be considered for the price?

The price which will be considered is the price of something in the area where it is present. (Bahar-e-Shari’at, vol. 1, pp. 908)

Which day will be considered for the price?

Neither that price will be considered when something was made nor that price when It is paid. In fact, that price will be evaluated and considered [which something is worth] at the time when the year of Zakah completes. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 133)

Method for calculating :

- You wish to pay It in the form of money, or

- In the form of gold or silver (zakat al mal)

- If you wish to pay It in the form of money, following is the easiest calculation: On the completion of the year of It, find out their price and then pay its 2.5 % (i.e. 2.5 rupees for every hundred rupees) as It. In this way, some additional amount of money might be paid but it is certain that Zakah will be paid completely and the additional amount will be considered to be Nafl Sadaqah.

- If you wish to pay the Zakahat of gold in the form of gold or the Zakat of silver in the form of silver, you will have to give its 1/40th part (i.e. 2.5%) as Zakah. The method for its calculation is as follows: (According to the information obtained from a goldsmith), one Tola is approximately equal to 11 grams 665 milligrams. Therefore, the Zakah of 7.5 Tolas (2.5%) will approximately be 187 grams of gold and Zakahat of 52.5 Tolas of silver (2.5%) will approximately be 15.310 grams of silver. If you own some amount of gold or silver more than the Nisab, the easy method is to pay 2.5% of the total amount of gold or 2.5% of the total amount of silver as Zakah. In this way, some additional amount might be paid but it is certain that Zakah will be paid completely and the additional amount will be considered to be Nafl Sadaqah.(Fatawa-e-Razawiyyah, vol. 10, Bahar-e-Shari’at, part. 5) > Note: For learning the complete method of the calculation of Zakah, please read part 5 of Bahar-e-Shari’at.

The ruling on impurity

Following are the three cases of gold or silver containing impurity:

- If the gold or silver is more than the impurity, the total metal will be considered as gold or silver, and Zakahat is Wajib [compulsory] for the total amount.

- If impurity is equal to the gold or silver, Zakah is still Wajib.

- If impurity is more [than gold or silver], then [this metal] will not be considered as gold or silver. Its two cases are as follows:

- If it contains gold or silver in such an amount that if separated, it will reach the Nisab, or it does not reach the Nisab but a person owns some more wealth such that it will reach the Nisab when both are combined, or it is used [by the people] as ‘ثَمَن’ [currency] and its price reaches the Nisab, then Zakah is Wajib in all of these cases.

- In case none of these cases apply, then if a person has the intention of trade for it and the conditions of trade are also met, consider it [in the category of] trade goods and if its price reaches the Nisab, either alone or after combining with other wealth, then Zakah is Wajib, otherwise not. (Bahar-e-Shari’at, vol. 1, pp. part. 5, Mas’ala No 6, pp. 904)

Zakah of jewellery

it will also become Fard for jewellery which is worn. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 1, pp. 270)

Bangles of fire

A woman came in the blessed court of the Beloved Rasool (peace be upon him) ٖ. She was accompanied by her daughter who had thick gold bangles in her hand. The Beloved Rasool ٖ asked that woman: ‘Do you pay It of these [bangles]?’ The woman humbly replied: ‘No.’ The Beloved Rasool said: ‘Are you happy with it that on the Day of Judgement, Allah makes you wear bangles of fire in exchange for these bangles?’ Listening to it, she immediately placed those bangles in front of Rasoolullah and said: ‘These are for Allah and His Rasool (peace be upon him) .’ (Sunan Abi Dawood, vol. 2, pp. 137, 1563)

Gold and silver jewellery and crockery

If the Zakah of gold and silver jewellery, crockery, etc. is given in rupees [i.e. money], the price of actual gold or silver will be considered. (Fatawa-e-Amjadiyyah, vol. 1, pp. 378)

The use of gold and silver crockery

On page 38, 39 of part 16 of Bahar-e-Shari’at, Allamah Maulana Mufti Muhammad Amjad Ali A’zami has stated: It is forbidden for both men and women to eat and drink in gold and silver crockery, apply oil from gold and silver bowls, apply Itr [perfume] from gold and silver bottles and inhale smoke of incense from gold and silver braziers.

It is forbidden for both men and women to eat with gold and silver spoons, apply Surmah [a type of kohl] using gold and silver needles or bottles, look into gold and silver mirrors, use gold and silver pens and inkpots to write, perform Wudu using gold and silver ewers or basins and sit on gold and silver chairs. It is impermissible to use gold and silver tea sets. There is no harm in using gold and silver items for only decorating the house; for example, placing their crockery, pens and inkpots properly to decorate the house. Likewise, there is no harm in decorating the house with gold and silver chairs, tables, benches, etc. if a person does not sit on them.

Zakah of dowry

Since the woman owns dowry, she will have to pay its Zakah if it becomes Fard.

The Zakah of wife’s jewellery

If the husband has given jewellery to his wife, the wife will pay Zakah in case he has transferred the ownership of that jewellery to her. However, if he is still its owner and has given it [to her] only for wearing it, then the husband will pay Zakah. (Fatawa-e-Razawiyyah, vol. 10, pp. 133) If the husband explains but the wife does not still give Zakah! If the wife does not give the Zakah of jewellery despite the fact that her husband explains [to her], the husband will not be held accountable for it. It is stated in the Holy Quran: (The fact is) that no burdened soul bears another soul’s burden? [Translation of Quran (Kanz-ul-Iman)](Part. 27, Surah An-Najm, Ayah 38)

However, it is compulsory for the husband to explain [to his wife] in a proper manner as it is stated in the Holy Quran: O believers! Save yourselves and your families from the Fire; the fuel of which are humans and stones [Translation of Quran (Kanz-ul-Iman)](Part. 28, Surah At-Tahreem, Ayah 6) (Fatawa-e-Razawiyyah, vol. 10, pp. 132)

The Zakah of mortgaged jewellery

(i.e. مرتن) nor on mortgagor (i.e. راہن) because the mortgagee does The Zakah of mortgaged jewellery is neither [due] on mortgagee not own it whereas the mortgagor does not possess it. When the mortgagor will take that jewellery back, Zakah of the previous years will not be Wajib [compulsory] on him. (Fatawa-e-Razawiyyah, vol. 10, pp. 146)

What if the husband has mortgaged the wife’s jewellery?

The mortgaged jewellery will not be included in the calculation ofZakah. (Fatawa-e-Razawiyyah, vol. 10, pp. 147)

Method of paying the Zakah of jewellery for the previous years

If someone owns jewellery and he or she has not paid Zakah for many years, in order to make calculation of the Zakah for previous years, it will be noted whether there has been any increase or decrease in the amount of jewellery after becoming the owner of Nisab, or not. If there has not been [any increase or decrease], find out the price of the jewellery on the day of completion of the first year [of Zakah] and pay its Zakah. Thereafter, if the remaining jewellery reaches the Nisab, find out its price on the day of completion of the second year and pay Zakah. If the remaining jewellery still reaches the Nisab, find out the price of the jewellery on the day of completion of the third year and pay Zakah. [i.e. keep on repeating it in the same way]. (Fatawa-e-Razawiyyah, vol. 10, pp. 128)

If there has been an increase or decrease in the amount of jewellery, subtract the decreased amount from the Nisab on the day of completion of every year, find out the price and pay Zakah; if there has been an increase [in the amount of jewellery], include it in the Nisab and pay Zakah.

Is Zakah Wajib upon the person who uses gold impermissibly?

Whether or not it is permissible for the owner to use gold and silver, it is Wajib [compulsory] upon him to give its Zakah. It is stated in Durr-e-Mukhtar: It is compulsory [to pay] 1/40 part as Zakah for the items made of both (gold and silver), even if they are in the form of bars or jewellery; whether it is permissible to use them or forbidden. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 1, pp. 270)

Zakah for diamonds and pearls

Zakah is not Wajib for diamonds and pearls, even if they are worth thousands [of rupees]. However, Zakah is Wajib if they are purchased with the intention of trade. (Durr-e-Mukhtar, vol. 3, pp. 230)

Zakah for gold or silver embroidery If someone has gold or silver embroidery on his clothes, Zakah will be [Wajib] for it as well. (Fatawa-e-Amjadiyyah, vol. 1, pp. 377)

The Zakah of the money saved for Hajj

The Zakah of the money saved for the journey of Hajj and Ziyarate-Madinah [blessed visit to Madinah] will have to be given if the conditions which make Zakah Wajib are fulfilled. (Fatawa-e-Razawiyyah, vol. 10, pp. 140)

TRADE GOODS AND THEIR ZAKAH

Which goods are known as trade goods?

Those goods and property are known as ‘trade goods’ which have been purchased with the intention of selling [i.e. trade]; if the intention of trade has been made after purchasing them or after receiving them in inheritance, then these [goods and property] will not be regarded as trade goods. (Radd-ul-Muhtar, vol. 3, pp. 221)

For example, if Zayd purchases a motorcycle with the intention that he will sell it and earn profit, it falls into the category of trade goods. If he purchases it for his personal use and at the time of purchase he does not have the intention of selling it, he only has the intention of using it but after purchase, he makes the intention that he will sell it if he earns a high profit, or if he makes a firm intention of selling it, even then, Zakah will not be Fard because the laws of Zakah will be applicable upon the intention that a person has at the time of purchase.

Trade goods left as estate

If someone leaves trade goods as estate, Zakah is Wajib provided that the heirs make the intention of trade after his demise. (Bahar-e-Shari’at, vol. 1, Part. 1, Mas’ala No 36, pp. 883)

The Nisab of trade goods

Zakah is Wajib for anything which falls into the category of trade goods and its price reaches the Nisab of gold or silver (i.e. price of 7.5 Tolas of gold or 52.5 Tolas of silver). (Bahar-e-Shari’at, vol. 1, Mas’ala 4, Part. 5, pp. 903)

The Zakah of trade goods

The 1/40 part (i.e. 2.5%) of the price will have to be given as Zakah. (Fatawa-e-Amjadiyyah, vol. 1, pp. 378)

The Zakah of the profit earned from trade goods

Zakah will be Fard for trade goods, not only for the profit. In fact, on the completion of the year, Zakah is [Fard] for both; the amount of profit [a person possesses] at that time as well as trade goods. (Fatawa-e-Razawiyyah, vol. 10, pp. 158)

The calculation of the Zakah of trade goods

For giving the Zakah of trade goods, find out their price and then give its 1/40 part as Zakah. (Fatawa-e-Amjadiyyah, vol. 1, pp. 378)

The price at the time of purchase or completion of the year

For trade goods, their price on completion of the year will be considered. (Bahar-e-Shari’at, vol. 1, Part. 5, Mas’ala 16, pp. 907)

The method of paying Zakah for a wholesaler

The day and time when the wholesaler had become the owner of the Nisab arrives on the completion of the year and other conditions are fulfilled, he should calculate and immediately pay the Zakah of all the goods he possesses at that specific time. Moreover, he should keep the record of the goods sold on credit and from the total amount [of those goods], when he receives onefifth part of the amount of Nisab, he should pay the Zakah of that received part. In the same way, as he keeps on receiving every fifth part, he should keep on paying the Zakah of that received part. (Radd-ul-Muhtar, vol. 3, pp. 281) However, the easy method is to give Zakah of the goods sold on credit at once so that a person does not have to make calculation again and again. (Fatawa-e-Razawiyyah, vol. 10, pp. 133)

The goods purchased on credit

Separate the goods purchased on credit from the actual goods and pay the Zakah of the remaining goods [i.e. the actual goods].

Will the wholesale price be considered or the retail price?

The wholesalers will calculate the [total] price according to the wholesale price and retailers will calculate it according to the retail price.

The method of calculation

The payer of the ‘Zakah of trade goods’ should make the calculation of Zakah in the following way:

- Currency notes:

- Money lent to someone:

- Trade goods sold on credit: Total:

Then, subtract from it the amount of money borrowed [from someone] or the value of trade goods purchased on credit; then pay 2.5% of the remaining amount as Zakah. Remember! It is not Wajib at present to pay Zakah of the money lent to someone or trade goods sold on credit, but it has been included in the calculation for ease [of calculation].

Will Zakah have to be given every year?

As long as the trade goods will keep reaching the Nisab either alone, or after combining with other types of wealth, Zakah will become Wajib on them every year provided that other conditions which make Zakah Wajib are fulfilled. (Fatawa-e-Razawiyyah, vol. 10, pp. 155)

Change of intention after purchase

Suppose a person purchased something, for example, a car, with the intention of trade but he changed his intention of selling it when he noticed that the car is better for his personal use. After some days, he needed money so he made the intention of selling the car but it could not be sold for the whole year; Zakah will not be [Wajib] for this car because if the intention of trade changes once for any item [of trade goods] or the intention of selling it is once changed and then the intention of trade is made for it again, it cannot come into the category of trade goods again [only because of this intention].

The Zakah of a shop

A shop purchased for trade will not be included in the Nisab. It is stated in Fatawa Shami: (There is no Zakah) for shops and lands. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 3, pp. 217)

The Zakah of a deposit

The deposit paid for renting a shop or a house will be included in Nisab because the deposit paid for renting a shop or a house is a type of debt in our Urf [usual practice]; therefore, it will also be included in the Nisab. (Waqar-ul-Fatawa, vol. 1, pp. 239)

The Zakah of the ‘soap of a launderer’ and ‘dye of a dyer’

In this regard, the rule states that if something is purchased for doing some form of work and its effect remains after the completion of the work, and it is equal to or greater than the Nisab, Zakah will become Fard for it upon the completion of the year. If its effect does not remain, Zakah will not be Fard even if it is equal to or more than the Nisab and the year also completes. Therefore, the Zakah of soap is not Fard on the launderer because it does not exist [after it is used], and Zakah is not [Fard] for such item, whereas Zakah will be [Fard] on the dyer because the colour remains on the cloth, so Zakah will be [Fard] for it. (Fatawa-e-Hindiyyah, vol. 1, pp. 172)

The Zakah of the bottles of a perfumer [Itr seller]

A perfumer keeps two types of bottles. The first type consists of small bottles which are sold with perfume [Itr]; their Zakah will be [Fard]. The second type consists of large bottles or glass jars which are filled with perfume and kept in a shop or a house but they are not sold; there is no Zakah for them. (Radd-ul-Muhtar, vol. 3, pp. 218)

Zakah upon the roti seller

Zakah is not [Fard] for the wood a roti seller purchases for cooking rotis (In India and the Caribbean) a type of unleavened bread.) or salt he purchases for mixing with flour. Zakah is [Fard] for the sesame seeds he purchases to use on rotis. (Fatawa-e-Hindiyyah, vol. 1, pp. 180)

The Zakah of books

If someone owns many books, Zakah will not be Wajib upon him because Zakah is not Wajib for books, provided that they are not for the purpose of trade. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 3, pp. 217)

The Zakah of rental property

Zakah is not [Fard] for the houses which are to be rented out even if they are worth Rs. 500 million. However, if the benefit [i.e. rent] obtained through them reaches the Nisab, either alone or after combining with other types of wealth and other conditions of Zakah are fulfilled, its Zakah will have to be given. (Fatawa-e-Razawiyyah, vol. 10, pp. 161)

The Zakah of rental cars and buses

Zakah will not be Wajib for rental cars or buses. However, the Zakah of the income [earned] from them will be Fard. (Fatawa-e-Faqih-e-Millat, vol. 1, pp. 306)

The Zakah of household items

If someone owns a television, computer, fridge, washing machine (oven, AC), etc., Zakah will not be Wajib on him, whether he uses them or not, because these are all household items; these are not Maal-e-Naami [i.e. the wealth that grows].(Waqar-ul-Fatawa, vol. 2, pp. 389)

The Zakah of decorative items

Zakah is not [Fard] for decorative items of the house, for example, copper crockery, porcelain crockery, etc. even if they are worth millions of rupees. (Fatawa-e-Razawiyyah, vol. 10, pp. 161)

The Zakah of the money paid as Bay’anah

In our society, Bay’anah ( A small amount of money paid in advance for purchasing property.) as surety is usually given before purchase to ensure that the person will certainly purchase that particular thing. This bay’anah is either a debt if the person [to whom it is given] has the permission to use it, or only a trust. In both the cases, this bay’anah will also be included in Nisab. (Fatawa-e-Razawiyyah, vol. 10, pp. 149)

The Zakah of a purchased item before taking possession of it

If someone purchases anything but does not take possession of it, Zakah will neither be [Fard] upon the buyer nor upon the seller. Zakah is not [Fard] upon the buyer as his ownership has not become Kamil [complete] because of not possessing it [and complete ownership] is a condition for Zakah to become Wajib.

Zakah is not [Fard] upon the seller as he no longer remains its owner because of selling it. However, after possessing it, the buyer will have to give Zakah of this year as well. On page 878, part 5, volume 1 of Bahar-e-Shari’at, Mufti Muhammad Amjad Ali A’zami has stated: If a person purchases goods or property for trade and does not take them into possession for the whole year, Zakah will not be Wajib upon the purchaser before taking possession; and after taking possession, Zakah is Wajib of this year as well. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 3, pp. 215; Bahar-e-Shari’at, vol. 1, Mas’ala 16, Part. 5, pp. 878)

The Zakah of currency notes

The Zakah of currency notes is also Wajib as long as they remain in use. (Bahar-e-Shari’at, vol. 1, Mas’ala No 9, Part. 5, pp. 905)

The Nisab of currency notes

When the price of currency notes reaches the Nisab of gold or silver, the Zakah of currency notes is Wajib as well. (Bahar-e-Shari’at, Mas’ala No 9, Part. 5, pp. 40)

The calculation of the ‘Zakah of currency notes’

1/40 part of the Nisab (i.e. 2.5%) will have to be given as Zakah. (Fatawa-e-Amjadiyyah, vol. 1, pp. 378)

A table for the ‘Zakah of currency notes’

| Amount | Zakah | Amount | Zakah |

| Rs. 100 | Rs. 2.5 | Rs. 1,000,000 | Rs. 25,000 |

| Rs. 1000 | Rs. 25 | Rs. 1 Crore | Rs. 250,000 |

| Rs. 10,000 | Rs. 250 | Rs. 10 Crore | Rs. 2,500,000 |

| Rs. 100,000 | Rs. 2,500 | Rs. 100 Crore | Rs.25,000,000 |

The Zakah of the money saved for the daughters’ marriage

If a person saves money for his daughters’ marriage and transfers its ownership to them before they become Baligh [i.e. reach puberty], Zakah will not be Fard upon them until they become Baligh because Zakah does not become Fard on a Na-Baligh (A child who has not yet reached puberty). However, Zakah will become Wajib upon them after they become Baligh if the conditions [of Zakah] are fulfilled. (Fatawa-e-Razawiyyah, vol. 10, pp. 144)

The Zakah of the money placed in trust

If a person spends the money placed in his trust by the consent of the owner, its owner will have to pay its Zakah. (Habeeb-ul-Fatawa, pp. 637)

The Zakah for insurance premiums

If the amount paid for insurance reaches the Nisab, either alone or after combining with other types of wealth, its Zakah will be [Fard] as well.

The Zakah of the amount of money paid for Hajj

Usually, from the amount of money paid for Hajj, some amount is deducted as travel costs and some amount of it is given to the Haji [a Muslim pilgrim] in Saudi Arabia for other expenses. The amount of money deducted as travel costs no longer remains under the ownership of the Haji because the money given in advance for the services does not remain under the ownership of the payer; instead, the payee becomes its owner. Therefore, this amount of money will not be included in the Nisab. The Haji is the actual owner of the amount of money he receives in Saudi Arabia and it lies under the category of debt in our Urf [usual practice].

Therefore, if this amount of money reaches the Nisab, either alone or after combining with other types of wealth, and a year has also passed on those types of wealth, its Zakah will become Fard. However, giving Zakah of the remaining amount of money he had given earlier is Wajib at the time when the person receives at least one-fifth part of the amount of the Nisab. (Fatawa-e-Ahl-e-Sunnah, Silsila No 4, pp. 27 – 28)

The Zakah for provident funds

Since this fund remains under the ownership of the owner [i.e. the employee], if the employee is the owner of Nisab, the Zakah of this amount of money will also keep on becoming Fard every year from the time when this amount of money started being saved. (Fatawa-e-Fayz-e-Rasool, Part. 1, pp. 479) However, its payment will become Wajib when at least one-fifth part of the amount of the Nisab is received. (Fatawa-e-Faqih-e-Millat, vol. 1, pp. 320)

The Zakah of the bonuses received by employees

Public sector or private sector employees receive some specific amount of money besides their salary at the end of the year which is known as a bonus. It is a form of gift and according to Shari’ah it lies under the category of Maal-e-Mawhoob (i.e. something that has been gifted). Therefore, ownership will not be transferred [to the employee] unless he takes possession of it; the employee will become its owner only after taking possession of it. Thereafter, its Zakah will be Wajib if it reaches the Nisab, either alone or after combining with other types of Amwaal-e-Zakah [wealth for which Zakah becomes Wajib]. (Jadeed Masa’il-e-Zakah, pp. 4)

The Zakah of the amount of money deposited in the bank

Although money is deposited in the bank as trust but in our Urf [usual practice], it is considered as debt because the depositor knows that the bank will invest his money in business, etc. Therefore, Zakah of this amount of money will be Wajib as well but it will be paid when at least one-fifth part of the Nisab is received. (Fatawa-e-Amjadiyyah, vol. 1, pp. 368)

In an explanatory note of Fatawa-Amjadiyyah, Allamah Mufti Muhammad Shareef-ul-Haq Amjadi has stated: Easiness lies in paying the Zakah every year of the total amount of money a person owns [even if he does not possess it at present]. One does not know when he meets death [all of a sudden] and the heirs may or may not pay Zakah; Satan misleads [people] in no time.

The Zakah of ‘the amount of a committee’

(In the subcontinent, the word ‘committee’ is also used in the sense of an agreement among a fixed number of individuals, called committee members, who all pay an equal amount of money each month, and the total amount deposited by all members is given to only one member each month either by a lucky draw or one by one in a predetermined order. This continues until all members get their full money back.)

The matter of a committee is similar to debt. Therefore, it will be noted that whether a person has received a committee or not. If he has received the complete amount of a committee, Zakah will be [Wajib] for the amount he has already deposited. The amount of money which still needs to be paid will not be included in the Nisab because it is like a debt on him. If he has not received the amount of committee, Zakah will become Fard upon the completion of the year provided that the Nisab is complete and the other conditions of Zakah are fulfilled. However, the payment [of Zakah] will become compulsory [Wajib] when at least one-fifth part of the amount of the Nisab is received. Thereafter, Zakah of that received part will be paid. (Fatawa-e-Ahl-e-Sunnah, Silsila No. 4, pp. 10)

The method of calculation

If the person paying committee has received the amount of committee, he should calculate Zakah in the following way:

Debt and Zakah

| Amount of money received: |

| Amount of money still to be deposited (subtract it from the amount received): |

| Total amount: |

Now, he should pay 2.5% of this total amount as Zakah.

Zakah on Madyoon

Zakah will be Fard upon a Madyoon (That person is known as a ‘Madyoon’ who owes dayn to someone. The thing which is (i.e. Wajib upon someone to pay) due to any contract such as ‘ [i.e. specific type of ‘Dayn’ which people refer to as ‘Dastgardan [in Urdu]’. People (Bahar-e-Shari’at, Part. 11, pp. 130) commercial contract]’ or ‘ [i.e. service contract]’, or ‘Tawaan [i.e. compensation]’ which becomes Wajib upon him because of destroying anything or the [payment] which becomes Wajib because of debt, are all called ‘Dayn’. ‘Debt’ is the name of a nowadays refer to every ‘Dayn’ as debt; this is contrary to the terminology used in ‘Fiqh [Islamic Jurisprudence]’.)provided that he owes such amount of ‘Dayn’ that if he pays it, the Nisab still exists; if the Nisab no longer exists, Zakah will not be Fard.On page 878, part 5, volume 1 of Bahar-e-Shari’at, Mufti Muhammad Amjad Ali A’zami (who passed away in 1367 Hijri) has stated: If a person is the owner of the Nisab but he owes dayn, such that after he pays it, the Nisab no longer exists, Zakah is not Wajib; whether that dayn is owed to a person such as a debt, or the cost (of something purchased), or Tawaan [compensation] for something, or that dayn is [an obligation] owed to Allah , such as Zakah and Khiraaj.

For example, someone is the owner of only one Nisab and two years have passed such that he did not give Zakah, then Zakah of only the first year will be Wajib, not of the second year as Zakah of first year is dayn that he owes and after it is deducted, the Nisab no longer exists; therefore, the Zakah of the second year is not Wajib. (Fatawa-e–Hindiyyah, vol. 1, pp. 172 – 174, Radd-ul-Muhtar, vol. 3, pp. 210)

Zakah on the Guarantor for a Madyoon

If a person is not Madyoon himself but is a Kafeel [guarantor] for a Madyoon and the Nisab no longer exists after deducting the amount of Kafalah (In the Shar’i terminology, ‘Kafalah’ means that one person shares the ‘[financial] obligation he owes’ with the other, i.e. one person actually owes a [financial] obligation, but the other one also takes on this [financial] obligation. For detailed information, read Bahar-e-Shari’at, part 12.)

Zakah is not Wajib. For example, if Zayd owns 1000 rupees and Bakr borrows 1000 rupees from someone and Zayd becomes his Kafeel, Zakah will not be Wajib upon Zayd in this case as although Zayd owns money, it is involved in debt owed by Bakr as the lender has the right to demand [the money] from Zayd and also to get him imprisoned in case he does not pay it. This money is involved in dayn; therefore, Zakah is not Wajib. (Radd-ul-Muhtar, vol. 3, pp. 210)

Does every type of dayn serves as an obstacle for Zakah to become Wajib?

Dayn (i.e. debt, etc.) which people cannot claim will not be considered in this matter, i.e. it does not serve as an obstacle for Zakah; for example, Nazr [vow], Kaffarah [atonement], Sadaqa-tulFitr, Hajj and Udhiyyah [animal sacrifice], as, even if the Nisab no longer exists after their amount is deducted from Nisab, Zakah is Wajib. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 3, pp. 211)

Becoming a debtor after the completion of the year

If a person becomes a debtor after the completion of the year upon the Nisab, Zakah will have to be paid because debt will serve as an obstacle for the payment of Zakah when one is burdened with it before Zakah becomes Fard. If a person becomes a debtor after completion of the year upon the Nisab, it will not be considered at all. (Radd-ul-Muhtar, vol. 3, pp. 215)

Mahr and Zakah

Mahr [dowry] of a woman is usually deferred [Mahr], i.e. it is demanded only after the [husband’s] death or divorce. A man does not even have a thought in all his expenses that he owes dayn (i.e. debt). Therefore, such Mahr does not serve as an obstacle for Zakah to become Wajib. So, Zakah will become Fard upon the person who owes Mahr if the other conditions are fulfilled. (Fatawa-e-Hindiyyah, vol. 1, pp. 173)

The Zakah of Mahr on a woman

There are two types of Mahr: Mu’ajjal (i.e. it has been agreed that the Mahr will be given before Khalwat)( Being alone with one’s own wife for the first time after marriage.) and Ghair-Mu’ajjal (for which any time period has been specified). If Mahr-Mu’ajjal of a woman is equal to or greater than the Nisab, then, upon receiving at least its one-fifth part, it will be Wajib to pay its Zakah. Usually, the time of payment is not specified for Ghair-Mu’ajjal Mahr and a woman cannot demand it before divorce or the death of her husband. Its Zakah will be Fard after she receives it, if the conditions [of Zakah] are fulfilled. (Fatawa-e-Razawiyyah, vol. 10, pp. 169)

The Zakah on the wife of a debtor

According to the worldly life, the matters of a husband and wife may be very closely interrelated but in the case of Zakah, they are entirely separate. Therefore, no matter how heavily the husband is burdened with debt, Zakah will become Wajib upon the wife if the conditions for Zakah to become Wajib are fulfilled. (Fatawa-e-Razawiyyah, vol. 10, pp. 168)

The ruling on dayn (debt)

The amount of our money which someone owes [to us] is called dayn. Following are its three types and the ruling on each type is different: Dayn-e-Qawee,

- Dayn-e-Qawee:

The money we have lent to someone is called Dayn-e-Qawee, or we have sold trade goods on credit, or purchased a plot or house for the purpose of trade and rented it out and someone owes that rent [to us].

Ruling: Its Zakah will keep on becoming Fard every year but the payment will be Wajib when at least one-fifth part of the amount of the Nisab is received; then, Zakah of that one-fifth part will have to be given. For example, suppose that the Nisab is 50,000 rupees; when its one-fifth part, i.e. 10,000 rupees, is received, it will be Wajib to give its 1/40 part, i.e. 250 rupees, as Zakah. However, easiness lies in paying its Zakah also every year.

- Dayn-e-Mutawassit:

The money [to be received] in exchange for anything other than trade goods is called Dayn-e-Mutawassit, such as someone sold a chair, bed or other things used in his house and the buyer owes its price [to him].

Ruling: Its Zakah will be Fard as well but the payment will be Wajib when the complete amount equal to the Nisab is received.

3.Dayn-e-Da’eef:

It is the money [to be received] in exchange for anything which does not fall into the category of ‘Maal’, such as Mahr, and rent for a house or a shop as it is [the money] in exchange for benefit, not in exchange for ‘Maal’.

Ruling: Zakah for it is not Fard for the previous years. When a person gains the possession of it and the conditions of Zakah are fulfilled, Zakah will be Fard on the completion of the year. (Durr-e-Mukhtar, vol. 3, pp. 281; Bahar-e-Shari’at, Part. 5, pp. 906)

No hope of receiving back the amount of dayn

If the person who owes us dayn (either Qawee or Da’eef) goes missing or denies that he owes us money and we don’t even have witnesses; in short, if there remains no hope of receiving back the amount of dayn, then it is not Wajib upon us to give Zakah. Fortunately, if he then returns the amount of dayn, Zakah of the previous years will not be Fard in this case. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 3, pp. 218)

The ruling on the reduction in Maal after Zakah has become Wajib

There are three cases of reduction in Maal [wealth]:

1. ≈س لا [Istihlaak]

It means a person’s own action causes the loss of money; for example, he spent it, or threw it away, or gave it to any Ghani [Shari’ah-declared wealthy person] as a gift, or gave it as Sadaqah with the intention of a Nazr [vow] or Kaffarah [atonement] or any other Wajib Sadaqah. In this case, even if the entire Maal [wealth] is lost, nothing will stand remitted from Zakah; Zakah in full will have to be given. It is stated in Fatawa Sirajiyah: If anyone wastes the Nisab, Zakah will not stand remitted. (Fatawa-e-Sirajiyyah, vol. 3, pp. 25)

It is stated in Durr-e-Mukhtar: If a person makes the intention of Nazr or any other Wajib, it is correct but he will have to guarantee [to give] Zakah. (Durr-e-Mukhtar, vol. 3, pp. 225)

2. صدق [Tasadduq]

It means that if a person gives [his Maal as] Sadaqah having no specific intention or if he gives it to any needy Faqeer [Shari’ahdeclared poor person] without making the intention of the payment of any Wajib or Nazr, Zakah will stand remitted in case he gives his entire Maal [wealth] as Sadaqah. It is stated in Fatawa Aalamgiri: He who has given his entire Maal as Sadaqah and has not made the intention of Zakah, his Fard will stand remitted. (Fatawa Hindiyyah, vol. 1, pp. 171) -e- However, if he gives some amount of Maal as Sadaqah, his Zakah will not stand remitted; he will have to give Zakah in full. (Fatawa-e-Razawiyyah, vol. 10, pp. 93)

3. ≈لا [Halaak]

It means that [Maal] is destroyed or lost without a person’s own action; for example, it is stolen, or he lends it to someone who later denies it and this lender does not even have witnesses, or the debtor dies without leaving estate, or the Maal was dayn (i.e. debt) upon any Faqeer and this lender forgives it. Its ruling is that the Zakah of the amount which is lost stands remitted, and Zakah is Wajib for the remaining amount, even if it is less than the Nisab.

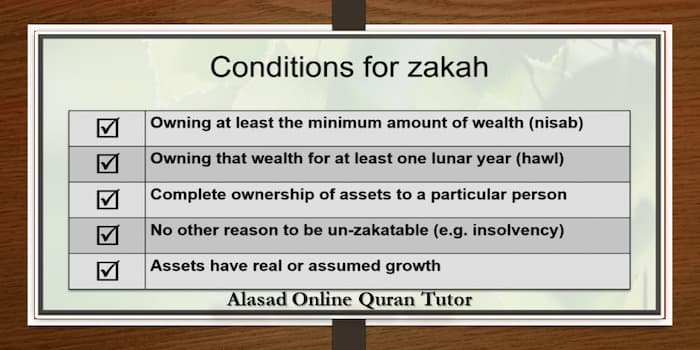

Write the details of conditions zakah in a year?,

Details of conditions : (The owner of Nisab)

Zakah | Zakat al Mal | Zakat – Learn Islam-Being the owner of Nisab means that a person has 7.5 Tola (A Tola is a traditional Ancient Indian and South Asian unit of mass, now standardised as 11.66 grams.) of gold, or 52.5 Tola of silver, or cash equal to its price, or trade goods whose value is equal to its price, or possessions exclusive of Haajate-Asliyyah whose value is equal to its price. (Derived from: Bahar-e-Shari’at, vol. 1, pp. 902-905)

The ruling on giving Zakah before becoming the owner of Nisab

If a person gives Zakah first and then becomes the owner of Nisab, the wealth he has given will not be included in Zakah; in fact, its Zakah will have to be given separately.(Al-Fatawa-e-Hindiyyah, vol. 1, pp. 176)

The Zakah on Haraam wealth

Zakah | Zakat al Mal | Zakat will not be Fard on the person whose total wealth is Haraam [unlawful] because he is not the owner of that wealth. It is stated in Durr-e-Mukhtar: If the total wealth is Haraam, there is no Zakah upon it. (Durr-e-Mukhtar, vol. 3, pp. 259). A’la Hadrat, Imam-e-Ahl-e-Sunnat, Maulana Ash-Shah Imam Ahmad Raza Khan has stated: How can that wealth become pure by giving the 40th part whose remaining 39 parts are also impure. (Fatawa-e-Razawiyyah, vol. 19, pp. 656) . It is necessary for such person that he repents and gets rid of the Haraam wealth.

The method of getting rid of Haraam wealth

There are two forms of Haraam wealth:

- Haraam wealth obtained through theft, bribery, usurpation and other similar means. The person who obtains it does not become its owner at all. Shari’ah has made it Fard to return this wealth to its owner; if he has died, it should be given to the heirs; if even they cannot be traced, it should be given to any Faqeer [Shari’ah-declared poor person] as charity without the intention of Sawab.

- That Haraam wealth by whose possession, a person acquires its impure ownership . It is the wealth acquired through any Aqd-e-Fasid [imperfect transaction], such as Riba [interest], or the earnings from shaving beard, cutting it to less than a fist length, etc. The same ruling applies to it as well but the difference is that it is not Fard to return it to its owner or his heirs; it can also be given to a Faqeer as charity without the intention of Sawab in the first place. However, it is Afdal [better] to return it to the owner or his heirs. (Derived from: Fatawa-e-Razawiyyah, vol. 23, 551 – 552

The meaning of Maal-e-Naami

Maal-e-Naami means the wealth that grows, whether it grows actually or as Hukmi [invisibly]. There are its three forms:

- This growth will be due to trade.

- This growth will be due to leaving animals in a jungle for breeding.

- The wealth will be Naami by nature like gold, silver, etc. (Al-Fatawa-e-Hindiyyah, vol. 1, pp. 174)

What is Haajat-e-Asliyyah?

Haajat-e-Asliyyah (i.e. basic necessities of life) refers to all those things which a person generally requires and one faces serious problems and difficulties in spending life without them, such as the house one lives in, clothes one wears, conveyance, books related to knowledge of Deen, tools related to one’s occupation, etc. (Al-Hidayah, vol. 1, pp. 96)

For example, the following are included in Haajat-e-Asliyyah: Telephone or mobile phone for those who need to contact different people; computer for those who write books using a computer or earn a livelihood through it; glasses or lenses for those who have poor eyesight; hearing aid for hearing-impaired people; likewise, bicycle for travelling; motor cycle, car or other vehicles; or other such things which a person needs and he finds difficulty in spending his life without them.

When will a year complete [for Zakah]?

The date and time when a person became the owner of Nisab, as long as the Nisab remains, the year will complete at the same minute when the same date and same time will come. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 202)

For example, at 12 pm on 12th of Rabi-ul-Awwal i.e. Eid Meelad-unNabi , Zayd received 7.5 Tola of gold, or 52.5 Tola of silver, or the amount of money equal to its value, or trade goods having value equal to its value; then, upon completion of the year at 12 pm on Eid Meelad-un-Nabi (12th of Rabi-ulAwwal), if he is still the owner of Nisab, paying Zakah of that wealth will become Fard [obligatory] upon him. He will become a sinner if he now delays paying the Zakah without any Shar’i reason.

Will lunar months be taken into account or calendar months?

For completion of the year, lunar months [i.e. months of Islamic calendar] will be taken into account. It is Haraam [prohibited] to take calendar months [i.e. months of the Gregorian calendar] into account. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 157)

Decrease in Nisab during the year

Since the start and end of the year are taken into account for Zakah to become Fard, if the Nisab of Zakah is complete on the completion of the year, the decrease (in Nisab) during the year has no effect; Zakah of the wealth [owned by the person] at that time will be given. (Durr-e-Mukhtar wa-Radd-ul-Muhtar, vol. 3, pp. 278, Wa-Fatawa-eHindiyyah, vol. 1, pp. 175)

For example, Bakr became the owner of 7.5 Tola of gold at 12 pm on 1st of Ramadan, so the same moment became the start of the year [of Zakah]. Then, he sold 1 Tola of gold in Shawwal, so the Nisab decreased. When Ramadan-ul-Mubarak was going to arrive next year, he received a gift of 1 Tola of gold from someone in the month of Sha’ban. So, he was again the owner of Nisab at 12 pm on 1st of Ramadan; therefore, he will now have to pay Zakah of that gold because the year has completed.

Increase in Nisab during the year

Zakah | Zakat al Mal | Zakat-If a person is the owner of Nisab and he gains some more wealth of the same category during the year, the year of this newly gained wealth will not be different; in fact, completion of the year for this wealth is the same as for the previously owned wealth, even if he has gained this wealth just a minute before the completion of the year. In this regard, it doesn’t matter whether this wealth has been gained through his previously owned wealth, or through inheritance, or as a gift, or by any other permissible means. If this newly gained wealth belongs to a different category, for example, a person first owned camels and now he got female goats, then a new, different year for it will be considered. (Bahar-e-Shari’at, vol. 1, pp. Mas’ala no. 43, pp. 884) Note: In this regard, gold, silver, currency notes and trade goods will all be considered as the same category. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 210)

For example, Zayd received 11,000 rupees on 11th of Rabi-ul-Sani, and then he received 12,000 rupees on 12th of Rabi-ul-Awwal in inheritance. He also received 25,000 rupees on 25th of Safar-ulMuzaffar as a gift or the house rent. In this way, Zayd possessed a total of 48,000 rupees at the end of the year. Now, according to Shari’ah, it is Wajib [compulsory] upon Zayd to pay Zakah of this total amount of money because all the currency notes fall into the same category; therefore, the same year of the previously owned 11,000 rupees will be considered for the amount of money which will be received during the year.

The loss of Nisab during the year

If the Nisab (Zakat al Mal ) is lost during the year such that none of it remains, the year [of Zakah] that had started will no longer be considered; the day on which he will become the owner of Nisab again will become the new beginning of the year [of Zakah (Zakat al Mal )

]. For example, a person became the owner of Nisab on 1st of Muharram and in Safar, he lost his entire wealth; then he gained wealth again in Rabi-un-Noor, so this same month will become the beginning of the year [of Zakah]. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 89)

Zakah in the state of Kufr

If a person who was previously a Kafir [unbeliever] embraces Islam, it is not Fard upon him to pay Zakah of [his past life he spent in] the state of Kufr because Zakah becomes Fard upon a Muslim, not on a Kafir. (Al-Fatawa-e-Hindiyyah, vol. 1, pp. 171 – 175)

Zakah on a Na-Baligh and insane person : Zakah is not Fard upon a Na-Baligh (Child who has not yet reached puberty.) There are some types of insane people:

- If a person remains insane throughout the year, Zakah is not Wajib upon him.

- If a person becomes sane in the beginning and end of the year, Zakah is Wajib upon him, even if he remains insane for the rest of the time period. (Derived from: Bahar-e-Shari’at, vol. 1, pp. 875)

Beginning of the ‘year of Zakah’ for an insane person

There are two types of Junoon [insanity]:

- Junoon-e-Asli

- Junoon-e-‘Aarzi

- If it is Junoon-e-Asli, i.e. a person becomes Baligh ( Person who has reached puberty) in the state of insanity, his year [of Zakah] will start when he becomes sane.

- If it is Junoon-e-‘Aarzi and a person remains insane throughout the year, the year [of Zakah] will start from the time when he regains sanity. (Derived from: Bahar-e-Shari’at, vol. 1, pp. 875)

The wealth for which Zakah becomes Fard

Zakah is [Fard] for three types of wealth:

- Gold and silver. (Their ruling applies to currency notes as well, provided that the notes are still in use).

- Trade goods.

- Saaimah, i.e. animals left for grazing. (Al-Fatawa-e-Hindiyyah, vol. 1, pp. 174, Fatawa-e-Razawiyyah, vol. 10, pp. 161, Bahar-e-Shari’at, vol. 1, pp. 882, Mas’ala 33)

The Nisab for gold and silver

The Nisab for gold is twenty Misqal, i.e. 7.5 Tolas, whereas the Nisab for silver is two hundred dirhams, i.e. 52.5 Tolas ( According to goldsmiths, 7.5 Tolas of gold approximately equals 87 grams and 48 milligrams, and 52.5 Tolas of silver approximately equals 612 grams and 41 milligrams.). (Bahar-e-Shari’at, vol. 1, pp. 902)

The Beloved Rasool has stated: When you own two hundred dirhams and a year passes on them, five dirhams are [Zakah] for them; and there is nothing upon you in gold until it becomes twenty Dinars. When you own twenty Dinars and a year passes on them, there is a half Dinar Zakah for them. (Sunan Abi Dawood, vol. 2, pp. 143, Hadees 1573)

What amount of Zakah will be given?

1/40th part of the Nisab (i.e. 2.5%) will have to be given as Zakah. (Fatawa-e-Amjadiyyah, vol. 1, pp. 378)

The ruling on the wealth which is more than the Nisab (Zakat al Mal )

If a person owns some amount of wealth which is more than the Nisab, it will be calculated whether the wealth more than the Nisab is equal to the one-fifth part (Khums) of the Nisab or not. If it is equal [to the one-fifth part], then 2.5 % of this one-fifth part (Khums), i.e. 1/40 part will have to be given as Zakah as well. If this additional amount of wealth is less than the one-fifth part (Khums), then it is exempted and there is no Zakah for it.

For example, if a person owns 8 Tolas of gold, he will have to pay Zakah of only 7.5 Tolas of gold because the additional amount of wealth (i.e. half Tola) is less than the one-fifth part of the Nisab (i.e. 1.5 Tolas). On the other hand, if a person owns 9 Tolas of gold, he will pay Zakah of 9 Tolas because this additional amount of wealth (i.e. 1.5 Tolas) is equal to the one-fifth part of the gold’s Nisab.(Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 85) ‘

Zakah for the wealth which is more than the Nisab and the one-fifth part

Zakat al Mal-The wealth which is more than the Nisab and the one-fifth part but less than the second one-fifth part, is exempted; there is no Zakah for it. For example, if a person owns 10 Tolas of gold, he will give Zakah of only 9 Tolas; the 10th Tola is exempted. On the other hand, if a person owns 10.5 Tolas of gold, he will give Zakah of 10.5 Tolas because the second one-fifth part is now complete. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 85)

Different types of wealth of the same category and the calculation of Zakah

If a person owns different types of wealth and each type is [individually] less than the Nisab, the total value of the entire wealth such as gold, silver, trade goods or currency will be calculated and the calculation of its Zakah will be made according to that Nisab which brings about more benefit to the Fuqara [poor people].

For example, if the [amount of] Zakah will be more in making its calculation by considering the entire wealth as silver, then calculation should be made accordingly; and if the [amount of] Zakah will be more by considering [the entire wealth as] gold, then the calculation should be made accordingly.

If [the amount of Zakah] remains the same in both cases, calculation will be made according to that type of wealth which is more commonly used by the people to pay Zakah. If both types of wealth are equally used by the people to pay Zakah, the Zakah-giving person has the choice that he may give Zakah according to gold or according to silver. It is stated in Fatawa Shaami: Combine [calculation] will be made according to the value [of that type of wealth] which will make the combine value reach the Nisab, not [the value] of the other. If both [types of] wealth make the combine value reach the Nisab and one of them is more commonly used, then the calculation will be made according to it. (Radd-ul-Muhtar, vol. 3, pp. 271)

It is stated in Sharah Niqayah: If both are equal (in being used by the people to pay Zakah), the Zakah-giving person will have the choice. (Sharah Niqayah, vol. 1, pp. 313)

If a person owns different types of wealth and each of them reaches the Nisab, there are three possibilities in this case:

First possibility: Each type of wealth is exactly equal to the Nisab and there isn’t anything more than the Nisab. (For example, a person owns 7.5 Tolas of gold and 52.5 Tolas of silver). In such case, if he wishes to [make] combine [calculation], that calculation will be made which results in greater [amount of] Zakah. (Derived from: Bida’-us-Sana’, vol. 2, pp. 108)

Second possibility: There will be some exempted amount of each type of wealth, more than the Nisab; so only the additional exempted amount of every type of wealth will be combined together and calculation will be made according to that Nisab which results in greater [amount of] Zakah. (For example, if a person owns 8 Tolas of gold and 53 Tolas of silver, both contain a half Tola of exempted amount, so calculation will be made after combining both of them.)

Third possibility: More than the Nisab, (Zakat al Mal) there will be some exempted amount of one type of wealth whereas the other type of wealth will have no exempted amount. In this case, only that additional exempted amount of the first type of wealth will be combined with the second type of wealth (having no exempted amount).

For example, if the Nisab of gold has an exempted amount and the Nisab of silver has no exempted amount, only the exempted amount of gold will be combined with silver. (If a person owns 8 Tolas of gold and 52.5 Tolas of silver, calculation will be made after combining the additional (exempted) amount of gold with silver.) (Derived from: Al-Fatawa-e-Hindiyyah, vol. 1, pp. 179, wa-Fatawa-e-Razawiyyah, vol. 10, pp. 116)

The Nisab of gold is complete and that of silver is incomplete

Any one of the both [types of wealth] whose Nisab is complete (having no exempted amount); the other type of wealth will be combined with it. For example, if there are 52.5 Tolas of silver and 4 Tolas of gold, the gold will be combined with the silver; and if it is the opposite case, i.e. there are 7.5 Tolas of gold and 40 Tolas of silver, then the silver will be combined with gold. (Fatawa-e-Razawiyyah, vol. 10, pp. 115)

The price of gold and silver as Zakah

Instead of [giving] gold or silver, it is [also] permissible to pay their price as Zakah. It is stated in Durr-e-Mukhtar: It is also permissible to pay the price as Zakah. (Durr-e-Mukhtar, vol. 3, pp. 250)

The Definition of price

According to Shari’ah, the market value of something is called its price. If something is purchased by chance or purchased for a greater or lesser amount after bargaining, this [amount, Zakat al mal] will not be called its price (in fact, it will be called ‘ثَمَن’). (Fatawa-e-Amjadiyyah, vol. 1, pp. 382)

Which price will be considered?

At the place where goods are actually sold according to the government rates, the same rates will be considered. If there is a difference between the government rate and the market rate, then the market rate will be considered. (Fatawa-e-Amjadiyyah, vol. 1, pp. 386)

Which area will be considered for the price?

The price which will be considered is the price of something in the area where it is present. (Bahar-e-Shari’at, vol. 1, pp. 908)

Which day will be considered for the price?

Neither that price will be considered when something was made nor that price when Zakah is paid. In fact, that price will be evaluated and considered [which something is worth] at the time when the year of Zakah completes. (Derived from: Fatawa-e-Razawiyyah, vol. 10, pp. 133)

Method for calculating the Zakah of gold and silver: There are two choices:

- You wish to pay Zakah in the form of money, or

- In the form of gold or silver (zakat al mal)

- If you wish to pay Zakah in the form of money, following is the easiest calculation: On the completion of the year of Zakah, find out their price and then pay its 2.5 % (i.e. 2.5 rupees for every hundred rupees) as Zakah. In this way, some additional amount of money might be paid but it is certain that Zakah will be paid completely and the additional amount will be considered to be Nafl Sadaqah.

- If you wish to pay the Zakah of gold in the form of gold or the Zakah of silver in the form of silver, you will have to give its 1/40th part (i.e. 2.5%) as Zakah. The method for its calculation is as follows: (According to the information obtained from a goldsmith), one Tola is approximately equal to 11 grams 665 milligrams. Therefore, the Zakah of 7.5 Tolas (2.5%) will approximately be 187 grams of gold and Zakah of 52.5 Tolas of silver (2.5%) will approximately be 15.310 grams of silver. If you own some amount of gold or silver more than the Nisab, the easy method is to pay 2.5% of the total amount of gold or 2.5% of the total amount of silver as Zakah. In this way, some additional amount might be paid but it is certain that Zakah will be paid completely and the additional amount will be considered to be Nafl Sadaqah.(Fatawa-e-Razawiyyah, vol. 10, Bahar-e-Shari’at, part. 5) > Note: For learning the complete method of the calculation of Zakah, please read part 5 of Bahar-e-Shari’at.

The ruling on impurity

Following are the three cases of gold or silver containing impurity:

- If the gold or silver is more than the impurity, the total metal will be considered as gold or silver, and Zakah is Wajib [compulsory] for the total amount.

- If impurity is equal to the gold or silver, Zakah is still Wajib.

- If impurity is more [than gold or silver], then [this metal] will not be considered as gold or silver. Its two cases are as follows:

- If it contains gold or silver in such an amount that if separated, it will reach the Nisab, or it does not reach the Nisab but a person owns some more wealth such that it will reach the Nisab when both are combined, or it is used [by the people] as ‘ثَمَن’ [currency] and its price reaches the Nisab, then Zakah is Wajib in all of these cases.

- In case none of these cases apply, then if a person has the intention of trade for it and the conditions of trade are also met, consider it [in the category of] trade goods and if its price reaches the Nisab, either alone or after combining with other wealth, then Zakah is Wajib, otherwise not. (Bahar-e-Shari’at, vol. 1, pp. part. 5, Mas’ala No 6, pp. 904)

Zakah of jewellery (Zakat on Gold)

Zakah will also become Fard for jewellery which is worn. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 1, pp. 270)

Bangles of fire

A woman came in the blessed court of the Beloved Rasool (peace be upon him) ٖ. She was accompanied by her daughter who had thick gold bangles in her hand. The Beloved Rasool ٖ asked that woman: ‘Do you pay Zakah of these [bangles]?’ The woman humbly replied: ‘No.’ The Beloved Rasool said: ‘Are you happy with it that on the Day of Judgement, Allah makes you wear bangles of fire in exchange for these bangles?’ Listening to it, she immediately placed those bangles in front of Rasoolullah and said: ‘These are for Allah and His Rasool (peace be upon him) .’ (Sunan Abi Dawood, vol. 2, pp. 137, 1563)

The Zakah of gold and silver jewellery and crockery

If the Zakah of gold and silver jewellery, crockery, etc. is given in rupees [i.e. money], the price of actual gold or silver will be considered. (Fatawa-e-Amjadiyyah, vol. 1, pp. 378)

The use of gold and silver crockery

On page 38, 39 of part 16 of Bahar-e-Shari’at, Allamah Maulana Mufti Muhammad Amjad Ali A’zami has stated: It is forbidden for both men and women to eat and drink in gold and silver crockery, apply oil from gold and silver bowls, apply Itr [perfume] from gold and silver bottles and inhale smoke of incense from gold and silver braziers.

It is forbidden for both men and women to eat with gold and silver spoons, apply Surmah [a type of kohl] using gold and silver needles or bottles, look into gold and silver mirrors, use gold and silver pens and inkpots to write, perform Wudu using gold and silver ewers or basins and sit on gold and silver chairs. It is impermissible to use gold and silver tea sets. There is no harm in using gold and silver items for only decorating the house; for example, placing their crockery, pens and inkpots properly to decorate the house. Likewise, there is no harm in decorating the house with gold and silver chairs, tables, benches, etc. if a person does not sit on them.

Zakah of dowry

Since the woman owns dowry, she will have to pay its Zakah if it becomes Fard.

The Zakah of wife’s jewellery

If the husband has given jewellery to his wife, the wife will pay Zakah in case he has transferred the ownership of that jewellery to her. However, if he is still its owner and has given it [to her] only for wearing it, then the husband will pay Zakah. (Fatawa-e-Razawiyyah, vol. 10, pp. 133) If the husband explains but the wife does not still give Zakah! If the wife does not give the Zakah of jewellery despite the fact that her husband explains [to her], the husband will not be held accountable for it. It is stated in the Holy Quran: (The fact is) that no burdened soul bears another soul’s burden? [Translation of Quran (Kanz-ul-Iman)](Part. 27, Surah An-Najm, Ayah 38)

However, it is compulsory for the husband to explain [to his wife] in a proper manner as it is stated in the Holy Quran: O believers! Save yourselves and your families from the Fire; the fuel of which are humans and stones [Translation of Quran (Kanz-ul-Iman)](Part. 28, Surah At-Tahreem, Ayah 6) (Fatawa-e-Razawiyyah, vol. 10, pp. 132)

The Zakah of mortgaged jewellery

(i.e. مرتن) nor on mortgagor (i.e. راہن) because the mortgagee does The Zakah of mortgaged jewellery is neither [due] on mortgagee not own it whereas the mortgagor does not possess it. When the mortgagor will take that jewellery back, Zakah of the previous years will not be Wajib [compulsory] on him. (Fatawa-e-Razawiyyah, vol. 10, pp. 146)

What if the husband has mortgaged the wife’s jewellery?

The mortgaged jewellery will not be included in the calculation ofZakah. (Fatawa-e-Razawiyyah, vol. 10, pp. 147)

Method of paying the Zakah of jewellery for the previous years

If someone owns jewellery and he or she has not paid Zakah for many years, in order to make calculation of the Zakah for previous years, it will be noted whether there has been any increase or decrease in the amount of jewellery after becoming the owner of Nisab, or not. If there has not been [any increase or decrease], find out the price of the jewellery on the day of completion of the first year [of Zakah] and pay its Zakah. Thereafter, if the remaining jewellery reaches the Nisab, find out its price on the day of completion of the second year and pay Zakah. If the remaining jewellery still reaches the Nisab, find out the price of the jewellery on the day of completion of the third year and pay Zakah. [i.e. keep on repeating it in the same way]. (Fatawa-e-Razawiyyah, vol. 10, pp. 128)

If there has been an increase or decrease in the amount of jewellery, subtract the decreased amount from the Nisab on the day of completion of every year, find out the price and pay Zakah; if there has been an increase [in the amount of jewellery], include it in the Nisab and pay Zakah.

Is Zakah Wajib upon the person who uses gold impermissibly?

Whether or not it is permissible for the owner to use gold and silver, it is Wajib [compulsory] upon him to give its Zakah. It is stated in Durr-e-Mukhtar: It is compulsory [to pay] 1/40 part as Zakah for the items made of both (gold and silver), even if they are in the form of bars or jewellery; whether it is permissible to use them or forbidden. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 1, pp. 270)

Zakah for diamonds and pearls

Zakah is not Wajib for diamonds and pearls, even if they are worth thousands [of rupees]. However, Zakah is Wajib if they are purchased with the intention of trade. (Durr-e-Mukhtar, vol. 3, pp. 230)

Zakah for gold or silver embroidery If someone has gold or silver embroidery on his clothes, Zakah will be [Wajib] for it as well. (Fatawa-e-Amjadiyyah, vol. 1, pp. 377)

The Zakah of the money saved for Hajj

The Zakah of the money saved for the journey of Hajj and Ziyarate-Madinah [blessed visit to Madinah] will have to be given if the conditions which make Zakah Wajib are fulfilled. (Fatawa-e-Razawiyyah, vol. 10, pp. 140)

TRADE GOODS AND THEIR ZAKAH

Which goods are known as trade goods?

Those goods and property are known as ‘trade goods’ which have been purchased with the intention of selling [i.e. trade]; if the intention of trade has been made after purchasing them or after receiving them in inheritance, then these [goods and property] will not be regarded as trade goods. (Radd-ul-Muhtar, vol. 3, pp. 221)

For example, if Zayd purchases a motorcycle with the intention that he will sell it and earn profit, it falls into the category of trade goods. If he purchases it for his personal use and at the time of purchase he does not have the intention of selling it, he only has the intention of using it but after purchase, he makes the intention that he will sell it if he earns a high profit, or if he makes a firm intention of selling it, even then, Zakah will not be Fard because the laws of Zakah will be applicable upon the intention that a person has at the time of purchase.

Trade goods left as estate

If someone leaves trade goods as estate, Zakah is Wajib provided that the heirs make the intention of trade after his demise. (Bahar-e-Shari’at, vol. 1, Part. 1, Mas’ala No 36, pp. 883)

The Nisab of trade goods