Is 401k Halal or Haram 2023? It’s not considered to be halal. Islamic experts have discovered that 401k’s investment isn’t believed to be Halal. In the realm of Islamic finance, the term “halal” refers to the products and actions that are permissible by Islamic law.

This includes investments that don’t include paying an interest (riba) and gaming (maysir) or any other usage of speculative techniques (gharar).

Is 401k Halal? There are a variety of opinions regarding whether or not the 401k account is Halal. Some claim it is while others say it’s not. What’s the difference? This blog will address the issue of whether 401k funds can be considered halal, and you must continue reading to the end so that you can be comfortable knowing that your money will go in the right place.

Table of Contents

- What exactly is Halal?

- What is the 401k?

- The benefits of A 401k Plan

- The disadvantages of a retirement plan are:

- How Does 401k Work?

- Does the 401k plan count as Halal and Haram?

- 401k vs roth ira

- FAQ

- Can the 401k plans of a business be considered to be Halal?

- What are the fundamental rules that are the basis of Islamic finance?

- Conclusion

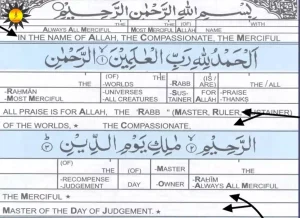

What is Halal?

Halal finance is one type of Islamic finance founded in Sharia law. It means any transaction has to be executed in a manner which is morally acceptable in accordance with Islamic law. Halal finance has grown in popularity in recent years as more Muslims seek out financial solutions and products that align to their religious.

There is a wide range of varieties of halal-compliant financial offerings and products in the form of Islamic banking institutions Islamic insurance (takaful) and the sukuk (Islamic bonds). Halal finance is usually regarded as an alternative than conventional finance as it doesn’t need charges for fees or interest for late payments. Additionally, the profits are distributed equally between shareholders.

Halal finance isn’t just for Muslims anyone can benefit from its ethical and clear method of performing financial transactions. If you’re looking for an institution for financial services that is in accordance with your religious beliefs and values Halal finance could be the ideal choice for you.

What is a 401k?

These plans can be described as pension savings plans. Employers can opt to have a certain percentage from their income taken out of their pay check and transferred into their account using the help of a account called a 401k. The money that is put in the account will not be taxed, and capable of being withdrawn when you retire. Additionally, you can contribute to employer-matching contributions. These give employees another option to save money to finance their retirement.

A 401k account is an ideal way to save money for retirement. The tax-deferred growth option and matching contributions could leave employees with substantial savings. It is essential to be aware that withdrawals made from 401k plans are tax-free, and early withdrawals are vulnerable to penalties. Employees should consult someone who is an expert on financial planning for advice on whether a retirement plan based on 401k is the best option for their requirements.

The advantages of the 401k plan

Tax benefits: Contributions to a 401(k) plan are tax-free which reduces your tax-deductible income and may lower your tax burden in general.

Employer contributions: Some employers may match contributions, which can significantly increase how much you can save.

Automatic savings The deducting from your wages helps you save money for retirement on regular basis.

Options to invest: 401(k) plan generally offer a range of investment options, such as index funds and mutual funds that permit the investor to expand their portfolio.

Potential for growth in the long run: Investing your money in an 401(k) plan over longer periods of time can result in significant growth for your savings.

The drawbacks of a 401k plan

Access to your funds is restricted: You may face penalties for withdrawing early or withdrawals, and you may not be in a position to access your account without penalty until the age limit of 59 1/2.

The limits on the control of the investment portfolio: The investment options available through the 401(k) plan are restricted and you may not have the same power on the portfolio that you have with other types of investments.

The costs of a 401(k) plan typically come with costs related to them, such as the cost of administration as well as expense ratios which could take away the savings you make over time.

Unable to move funds: If you leave your employer of choice it could be necessary to transfer the 401(k) savings into your new plan of your employer or IRA.

Limit on contributions: Maximum contribution limits are set by the government. It’s possible to find that you’re unable to contribute the money you’d like to.

employer termination Employers could decide to cancel the program or modify the plan’s terms, however this could not be beneficial for you.

What’s the purpose of a 401k plan?

It’s an 401(k) program that is a common method for individuals to save money for retirement. It could be a fantastic benefits offered by employers. If you’re a participant in a 401(k) plan, it’s essential to understand the basics of the way it operates. These steps will lead you through the way your money is put in and invested and then withdrawn when you retire. Understanding these steps will assist you in making informed decisions about your retirement savings and ensure you’re getting the most from your 401(k) program.

The company you work for offers a 401(k) plan. it allows you to be an employee with the right to participate.

You’re able to choose the amount of your salary you’d like to transfer in the 401(k) fund, typically via the deduction of your salary.

The money is taken from your pay before tax deduction, and transferred into savings in the 401(k) saving account.

You can choose the method by which your money is allocated from a range of options provided by the plan you’re on.

Your employer may match an amount of your contribution.

The earnings you make are tax-free until the time you retire.

Taxes are assessed on the amounts you withdraw when you retire.

The process of withdrawing is usually free of charge until when you reach 601/2 but there are some exceptions.

Does that retirement plan 401k Halal and Haram?

If you’re thinking of investing, there are a few things to take into consideration.

Knowing the risk associated with investing

Every investment has some risk and this is especially true for the market for stocks.

Possibility of earning money, but there is the possibility of losing money

Determining the Objective of Investment

If the main purpose is to earn money, it is not considered Halal.

If the aim will be to enhance the financial position of the family members or fund retirement savings it could be legal

Analyzing the Underlying Investments

It is vital to analyze the investment fundamentals.

When the investment portfolio comprises the shares that are part of the mutual fund that invest in businesses which manufacture and sell products that are Haram The whole amount of the investment will be Haram. If however the portfolio is made up of investments by companies that are considered to be halal, the investment is permissible.

There are a variety of reasons why 401ks can be considered to be haram. It is also possible to find companies that offer alternatives that are permissible for those who want to invest, while remaining loyal to their religion. With these resources, it is possible to remove any worries about engaging in haram practices!

In other words, if you take all these elements into consideration the 401k can be considered to be Halal. It is all dependent on the specific needs and goals of the person who invests.

401k vs roth ira

It is true that the Roth IRA and the 401(k) are both great methods to save money for retirement, but they differ in a variety of ways. The most significant difference is the amount you can invest into a year. The other distinction is that the Roth IRA has lower limits as compared to 401(k) which has higher limits.

Another distinction is who can contribute as a participant. Anyone who is employed by the company that has an 401(k) can contribute. However, only those who earn income or have incomes that are lower than certain thresholds are eligible be a contributor to a Roth IRA. The tax consequences of both plans are different. For contributions, Roth IRAs Roth IRA are made with tax-free money, while the contributions to the 401(k) could be done with tax-free money.

The investment options offered within the 401(k) are generally limited in comparison to the options available with the Roth IRA. In addition, the rules for withdrawal of funds differ for the two plans. One can be A Roth IRA allows you to take your contributions out anytime without penalty, however the earnings could be subject to tax and penalty when certain conditions are met.

For the 401(k) generally you aren’t able to withdraw money with no penalty after the age of 60 1/2 except if you meet certain requirements. It is also important to remember that it’s crucial to know that the 401(k) may be a plan sponsored by a company. However it is a Roth IRA. Roth IRA is an individual retirement account, which isn’t controlled by an employer.

For more information on other financial choices, such as the issue about how Forex trading is thought of as holy as well as haram make sure to read our blog!

Source reference The information above has been verified by Sharia Portfolio.

FAQ

Can a retirement plan based on 401k be classified as an halal plan?

It’s contingent upon the specific features of the 401k plan and whether it complies with the guidelines that form the foundation for Islamic finance. It is essential to understand the options for investing available within the plan, and also to check if they are conformity with the standards of Islamic finance.

What are the basic principles of Islamic finance?

Islamic banking system based on the principle of risk sharing and the avoidance from interest (riba) and also restricts investment in specific industries such as gambling, alcohol, or tobacco.

Conclusion

The most important thing to remember is that the answer to “is the 401k program is halal?” is is contingent on your personal circumstances as well as the specifics of the 401k plan that you employ. It is essential to understand the options for investing in the plan, and if they conform to the principles that govern Islamic finance.

It could be as easy as avoiding investing in certain sectors such as gambling, alcohol and tobacco, or making sure that a specific portion of the funds are invested in socially responsible and ethical businesses. It is also crucial to take a look at the charges and costs that are associated with the plan, and if they conform to the rules that govern Islamic finance.

If your employer offers an 401k program that is compliant with Islamic guidelines, then the plan can be deemed Halal. However, if your employer’s 401k plan doesn’t conform to Islamic standards, you can consider alternatives such as those offered by the Roth IRA or a SEP IRA which may be more in line with your beliefs. It is crucial to research and understand the options that are available to you to make an informed decision regarding saving for retirement. We thank you for spending the time to read!

Written By Hafiz Abdul Hameed

Abdul Hameed has been an Islamic scholar, as well as an author and consultant to Renewable Energy Maldives. He writes on Islamic financial issues, food as well as halal guidelines and diet. He is a prominent voice within the Muslim community and is well-known for his clear explanations of the intricate ideas of the religion. He is also asked to speak at numerous events and conferences on subjects related to Islamic finance, as in addition to food and renewable energy sources.

Click Here To Find Out:

- Are Fake Nails Haram?

- Is It Haram to Dye Your Hair?

- Are Lip Fillers Haram in Islam?

- Is CBD Halal? Quick Guide 2023

- Why Are Lash Extensions Haram?

- Are Anklets Haram? Updates 2023

- Are Hair Extensions Haram in Islam?

- Are Zodiac Signs Haram? Quick Facts

- Is Botox Haram In Islam? Quick Guide

- Best Halal Nail Polish Collections 2023

- Do Muslim Women Shave? Quick Facts

- Are Nose Jobs Haram? Quick Facts 2023

- Are Tampons Haram in Islam? Facts 2023