Why is Interest Haram? – No matter where they reside and what professions they work in, observant Muslims are faced with issues and questions about how to integrate their faith into their daily lives. However, a closer look at the issue suggests that we can learn several lessons to take from the Muslims.

Because some Islamic traditions and beliefs defy the norms and expectations of the establishments dominated by non-Muslims and non-Muslims, it is difficult to shake off the traditional.

Three popular concepts used by Muslims are halal, haram and the word riba. Each one influences Muslims every day behavior and their activities. We will examine whether and under what conditions it is permissible to eat riba for Muslims.

Riba is a reference to financial interest payments, which includes usury. The subject is however complex. Let’s discover why.

Suggested Read: Quran French, The Quran: English Translation, Textual Criticism and Qur’an Manuscripts

Suggested Read : Can Muslims Have Dogs?, Can Muslims Have Dogs?, Allah is The Best Planner

Haram vs Halal in Islam

Why is Interest Haram? – Halal and haram are both part of Islamic the law of religion (Shari’ah). These concepts define boundaries or set out restrictions on certain actions and behaviors.

This idea isn’t familiar to all religions, therefore we will discuss it the concept of riba before we discuss how halal and haram can be applied to it.

Haram

Haram is the term used to describe what is prohibited or illegal in accordance with Islamic law. There are many things that Muslims consider haram. These include such things as:

- Drinking

- Gambling

- Adoption

- Poetry

- Statues

- Instrumental music

- Playthings that are reminiscent of living organisms

- Directly or focusing on individuals of the opposite gender

- Interacting with others who are

Even though these examples and others may seem harsh or unjust to non-Muslims alike, each has moral roots within Islamic law. Islamic faith.

Halal

As a counter-balance to Halal, which is a synonym for haram, includes things that are considered legal to be lawful in Islam. In general, it is reasonable to conclude that everything that isn’t prohibited as Halal. However, there are some subtleties that require careful consideration.

For instance, many Muslims consume meat. However, the meat must be from non-carnivore animals, and these animals must have been killed humanely and in accordance with Islamic practices. The way an animal was killed is also an important factor.

Applying Halal and Haram

In the past, haram and Halal are most commonly applied to food consumption , maybe because eating is an everyday thing. It is important to note that halal and haram apply to the act of eating food items but not the food in that is eaten.

Since these terms are applicable to specific actions, it all comes down to the individual’s choice and judgement. In the end, haram food items will be present regardless of whether a person decides to consume them or not.

The broader meaning is applicable to many different scenarios, among which is the riba. The process of the riba is a completely human choice and has always been.

Like other halal vs distinctions it can be difficult to know which category an issue or idea is placed on can be difficult in the context of the riba.

What Is Riba?

Riba refers to an Islamic term that is generally used to refer to expansion, growth or growth. In terms of the concept, it is used to describe the interest earned to loan holders or accrued from bank deposits.

Riba can also refer to the seeking of illegal, exploitative profits in trade or business by calculating exorbitant rates of interest, also known as usury, otherwise known as.

The Origins of Riba

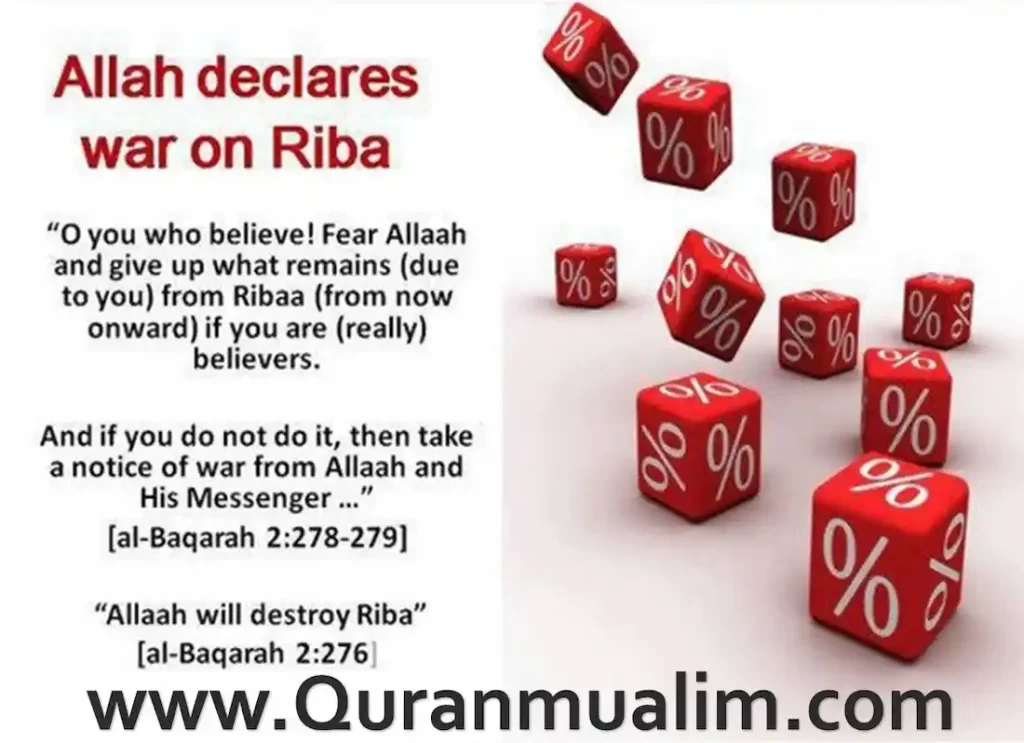

The origins of riba originate from ancient times and are pre-dating the writing in the Qu’ran. Although riba is mentioned in passing in the Quran’s sacred text, certain passages provide a lasting message.

This message is a synthesis of passages such as the ones below, and many others that strengthen the message’s overall meaning

- “Allah has allowed trade and has forbidden riba” (2:275)

- “You who are a believer don’t eat Riba, which has doubled and doubled. Be aware of God to ensure that you succeed.” (3:130)

It’s quite an undertaking to interpret sacred texts of the past in a way that is applicable to the present. It’s the reason that a variety of later documents explain Islamic financial matters and the appropriate way to view it as the riba.

It is not surprising that the most popular are the first Islamic texts — the Hadith — which form the most authoritative account and announcement of the Qur’an which is Islam’s holy scripture that was written by Mohammed, prophet of Islam. Muhammad.

The Hadith is a compilation of Muhammad’s words as well as his teachings and is second after the Qu’ran itself as a reliable Islamic text.

All kinds of Islamic finance do not allow the practice of riba. However, none of the financial transactions can be considered the definition of as riba, in accordance with the Qur’an and the Hadith.

Suggested Read: Online Quran Teacher For Kids and Color Coded Quran , Can Muslim Men Wear Gold?

The Types of Riba

Why is Interest Haram? – There are two kinds of the riba. The first one, which is the most well-known is a loan agreement (Riba al-Nasiyah) in which any excess amount is added to the initial loan amount is charged to the loaner.

The second is an exchange or sale agreement (Riba al-Fadl). This is applicable only to goods like rice or wheat, oil sugar, and so on. If two individuals exchange the same product in unrelated amounts, the additional is called known as riba.

How People Today Think of Riba

A lot of Muslims are today unable to articulate concepts about the notion of the concept of riba. Yet, many believe it is essential. For instance, scholars from Islam have proposed that there is a “riba-free” society and consider it to be the best option for everyone.

Riba is seen as to be a socially damaging by sociologists, economists as well as religious scholars and other scholars of different religions because of the injustices that it propagates and allows.

Why Is Riba Prohibited?

Why is Interest Haram? – In simple terms, riba keeps poor people poor and the rich rich. The poor are burdened with constant replenishment of debt. The wealthy, on the other hand, accumulate wealth primarily through the wealth they’ve already amassed — and this increases due to the accrual of interest.

Muslims are not the first to recognize that the practice of riba (or similar practices in different religions and religions) is not ethical and creates the gap between the distribution of wealth and privilege. It is a fact that things will get worse, not better.

It is best to make loans charitable (not Riba). Islam promotes fair and equitable trade since it is an equal exchange. One side has goods or services to market while the other has cash to pay.

This type of transaction promotes economic interdependence, and thus justifying the revenue generated from selling. If you make a fair trade you risk however it is not a guarantee of a rise in prosperity without the risk of any risk of responsibility.

In Islam it is considered to be an act of kindness, not an opportunity to increase wealth. The purpose of a loan is to assist people in need. The loans (qard) don’t have interest. In qard al-hasan the borrower pays only the principal amount of the loan.

The Qur’an often compares charity to the practice of usury (riba) and is as among the 7 most harmful sins since the time of Qu’ran’s creation.

Suggested Read: Is Cutting Your Hair A Sin? , Black Stone Kaaba (Hajr-e-Aswad), Allahumma Innaka Afuwwun Hadith

Dilemmas Over Riba

While many modern Muslims accept the prohibition of riba However, there is a wide range of disagreement on the exact meaning. Do you have a description of “riba”?

Do you have a rule of thumb to determine what constitutes the definition of riba (and hence the definition of haram) or considered halal? Here are some examples of how these questions were solved.

Can Muslims Invest in the Stock Market?

We are aware that when it is Islamic investments, Islamic principles require that stock investors share in the profits and loss, they are not paid any interest (riba) as well as that they not invest in companies that are prohibited under Islamic law.

This is why we let our customers to choose which investment option to use their money. We only invest what you entrust to us in an Islamically compliant, government-registered superannuation fund. This ensures that your retirement savings are in compliance with Islamic Shariah.

How Do Muslims Buy Homes?

The purchase of a house which is secured by a mortgage something that people do on a regular basis. But it isn’t just illegal to purchase anything using the use of interest-based financing for Muslims however, it’s financially foolish and could become an expense.

By using the financing system People can easily lose their homes by spending prior to making. This can result in massive financial losses as well as long-term loans. Why would you want to buy a house when you don’t have enough cash to purchase it in advance?

What if You’re a Muslim and Owe Interest Payments?

The answer to this question requires another question, and two possible answers. The issue is “how did you let yourself get into interest-bearing debt in the first place”? Then you wouldn’t be in the position of defending Shari’ah.

The initial answer is to make use of trust as the base to bargain your way out of having to pay the cost of interest. If that fails then you can clear your debts by paying the maximum amount you can in one go.

These examples of problems provide a crucial lesson. Texts of the sacred are usually composed over a long period and written by many people. Experiences from multiple people attest to an understanding of the reasons why things aren’t working.

This universal wisdom isn’t only for Muslims only.

Riba in the 21st Century

Suggested Read: The Clear Quran, El Coran and The Essential Book of Quranic Words

The study of how the Islamic idea of the riba could provide us with better ways to think about living within the 21st Century. Not only do we face cultural barriers across the globe however, there are also a lot of disparities in equity across the entire population.

The wisdom of holy texts such as the Qu’ran the Hadith and other well-known names might seem outdated and obsolete — perhaps they are, in a certain way. But , we must look at them with open hearts, eyes and minds for the timeless lessons they offer.

Are you an Muslim resident of Australia? If yes, do require genuine Islamic advice on investing in halal methods? You’ll be happy being confident that Crescent Wealth Funds respects you the value of your investment, as well as your convictions.

Are there any hints of interest present in Bank Haram?

Many Muslims and the majority of “non-Muslim observers of the Islamic world” consider that the lending interest (also on bank deposits, etc.) is a violation of Islam. (Such credit — as well as the the banks that provide them are often referred to as ribawi i.e. carrying the riba.)

Are bank interest Harams a part of Islam?

“According the Islamic laws the interest offered by banks is ‘haram’ (prohibited) therefore it can’t be utilized. However, the interest is able to be distributed to those who are poor or disabled, without the intention of the concept of sawab (reward).

Does the concept of interest for money Haram?

In Islam the religion of Islam, it is prohibited to Muslims to receive as well as be liable for an interest (Riba). This means that Muslims can’t charge interest on loans or on money due. Bank accounts usually accrue the interest over time. This means that lots of Muslims accidentally earn interest but do not actively seek to.

Is bank interest a riba?

The majority of jurists believe that it’s not legal and Muslims shouldn’t accept any the interest they earn on bank deposits. … The second half of the 20th century, many Muslim intellectuals came up with the idea of Islamic banking that was based in mudaraba, and profit-sharing.

Why is it that interest is not permitted in Islam?

In fact, charging interest from a person who has to take out loans to meet an vital consumption needs is regarded as an act of exploitation in Islam. Interest on loans used for productive purposes is also forbidden since the practice isn’t an equitable method of transaction.

Are you keeping your money in a bank the same as haram?

A Savings Account at the Bank isn’t Haram until you don’t consume the interest that they pay. The majority of people do not ever touch the interest balance in their accounts, and when they close the account , they give the amount to the bank.

It is it considered haram to make payments on a car?

Interest charges (riba) isn’t permitted in accordance with Sharia law, which is why certain kinds of finance for cars aren’t considered halal. However, finance is accessible to Muslims. Halal car financing – commonly known as Islamic car finance – permits you to purchase a brand-new or used car without the need to pay cash, and still adhere to the rules in Sharia law.

Does tax haram exist in Islam?

Taxes are Haram and there’s something more beneficial in Islam it’s known as Zakatu-almal. You must study it and then compare it with the rules on taxes and you’ll find that zakat is fair and more beneficial for both rich as well as the poor.

What is the definition of prohibited in Islam?

Riba is an idea in Islamic banking that is used to refer to the charge of interest. It’s also described as usury or the charge of excessively high interest rates. Another version of riba, according to many Islamic jurists, that is the exchange of goods in different quantity or in different qualities.

Are bank profits not halal?

This is the case for Conventional banking since their main business is loaning and borrowing money. the difference between borrowing and lending is called the “Earning”. The earnings are thought of as Haram to Islam.

Do banks in Saudi Arabia charge interest?

Islamic law forbids the charging of interest or any usury (i.e. the lending of money at outrageous or unconstitutional rate in terms of rates). … However, Islamic banking institutions are banks nonetheless, and that implies that they are also seeking to earn money for their customers.

What do the Quran have to say regarding the subject of interest?

“O believer, don’t take doubled or redoubled interest and be afraid of God to help you be successful,” reads Surah Al Imran, verses 13 to 132 of the Quran. Interest is considered to be a grave sin in Islam and both are forbidden.

It is it considered haram to pay interest on a home?

- “It’s haram,” according to the Muslim, which means that it is prohibited from a religion perspective.

- The wrong choice is to decide what’s wrong. The term “interest,” or”riba” is a crime according to Islamic law. It is also known as the word riba.

- Muslims who wanted to purchase a home needed to save many thousands or borrow money from relatives or to let go of their religious beliefs and get a conventional mortgage that was very difficult.

What religion does not be able to pay interest?

Riba can be described as an Islamic concept that is generally related to the notions of growing increasing, growing, and surpassing and also prevents the crediting of interest on deposits or loans.

Is the cost of interest on a loan illegal?

Islamic law considers lending that involves interest to be an arrangement that is biased towards the lender who pays interest at the expense of the borrower, not than the lender. Interest is considered to be an act of riba and the practice of accruing interest is a crime according to Islamic law. It is considered haram, which is a reference to forbidden, as it is considered to be usury and exploitation by Muslims.

What can we do to avoid the plight in Islam?

How do you stay clear of Riba? Islam views lending with interest payments as a type of relationship that benefits the lender from the borrower’s inability repay the loan. Islam is against making interest payments since it is considered to be the act of riba. The practice, considered to be a form of usury and exploitation and is called haram. This means ”forbidden’. It is a sin.

READ ALSO:

| The Holy Quran | El Coran |

| Mushaf al-Madinah | Quran French |

| The Clear Quran | Tajweed Rules |

| Quran Kareem | The Study Quran |

| The 99 Names of Allah | Laylat-ul-Qadr |

Shariah FAQ